Latest Post

ESG Regulations Oman: ESG reporting evolution demands strategic action: From impact to financial risk

ESG Regulations Oman: ESG reporting evolution demands strategic action: From impact to financial riskOman’s approach to ESG is closely aligned

EU CBAM Verifiers: Complete Guide and Checklist for Indian Exporters (2026 Ready)

EU CBAM verifiers are a critical part of the Carbon Border Adjustment Mechanism (CBAM) ‘s definitive phase, which starts on

ESG Regulations Oman: ESG reporting evolution demands strategic action: From impact to financial risk

ESG Regulations Oman: ESG reporting evolution demands strategic action: From impact to financial riskOman’s approach to ESG is closely aligned

EU CBAM Verifiers: Complete Guide and Checklist for Indian Exporters (2026 Ready)

EU CBAM verifiers are a critical part of the Carbon Border Adjustment Mechanism (CBAM) ‘s definitive phase, which starts on

Featured Post

12 challenges faced by EU importers under CBAM

Carbon Border Adjustment Mechanism and 12 major challenges for EU importers and EU traders.

Top 5 sustainability management and reporting software to achieve Netzero

A look at 5 sustainability management and reporting software to achieve Netzero in your

Causes and prevention of Groundwater Pollution

Groundwater pollution in India stems from both natural sources like arsenic and fluoride, and

LogicLadder Empowers Central Pollution Control Board

LogicLadder Empowers Central Pollution Control Board With Real Time Monitoring Of Pollution By Indian

CBAM update: EU leaves Indirect Emissions out of scope for metals and scrap is now a separate product: Know more!

The European Union has released a critical CBAM update that reshapes how metal exporters

Data Diode and its application in Industrial IoT

IIoT or Industrial Internet of Things, defined as the interconnected network of sensors, instruments,

Telemetry System for Groundwater Monitoring as per Central Ground Water Authority (CGWA) NOC Guidelines

Looking for a Groundwater Monitoring Telemetry System? As per the latest CGWA guidelines, it’s

Carbon Accounting in India: Best way to unlock Carbon Markets

Discover how carbon accounting in India can unlock lucrative carbon markets, enhance business sustainability,

ESG Regulations Oman: ESG reporting evolution demands strategic action: From impact to financial risk

ESG Regulations Oman: ESG reporting evolution demands strategic action: From impact to financial riskOman’s approach to ESG is closely aligned with its long-term national priorities, as the country looks to

EU CBAM Verifiers: Complete Guide and Checklist for Indian Exporters (2026 Ready)

EU CBAM verifiers are a critical part of the Carbon Border Adjustment Mechanism (CBAM) ‘s definitive phase, which starts on January 1, 2026. Recent published regulations also point to one

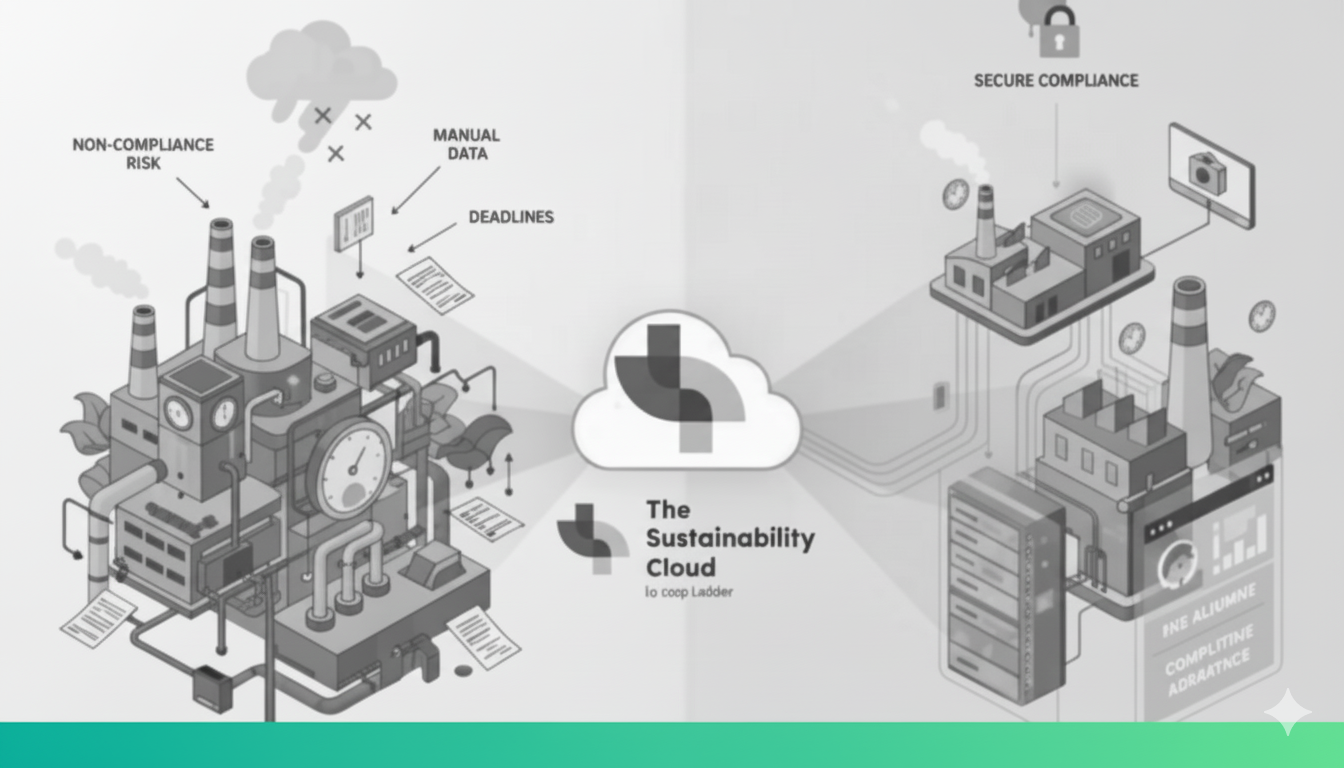

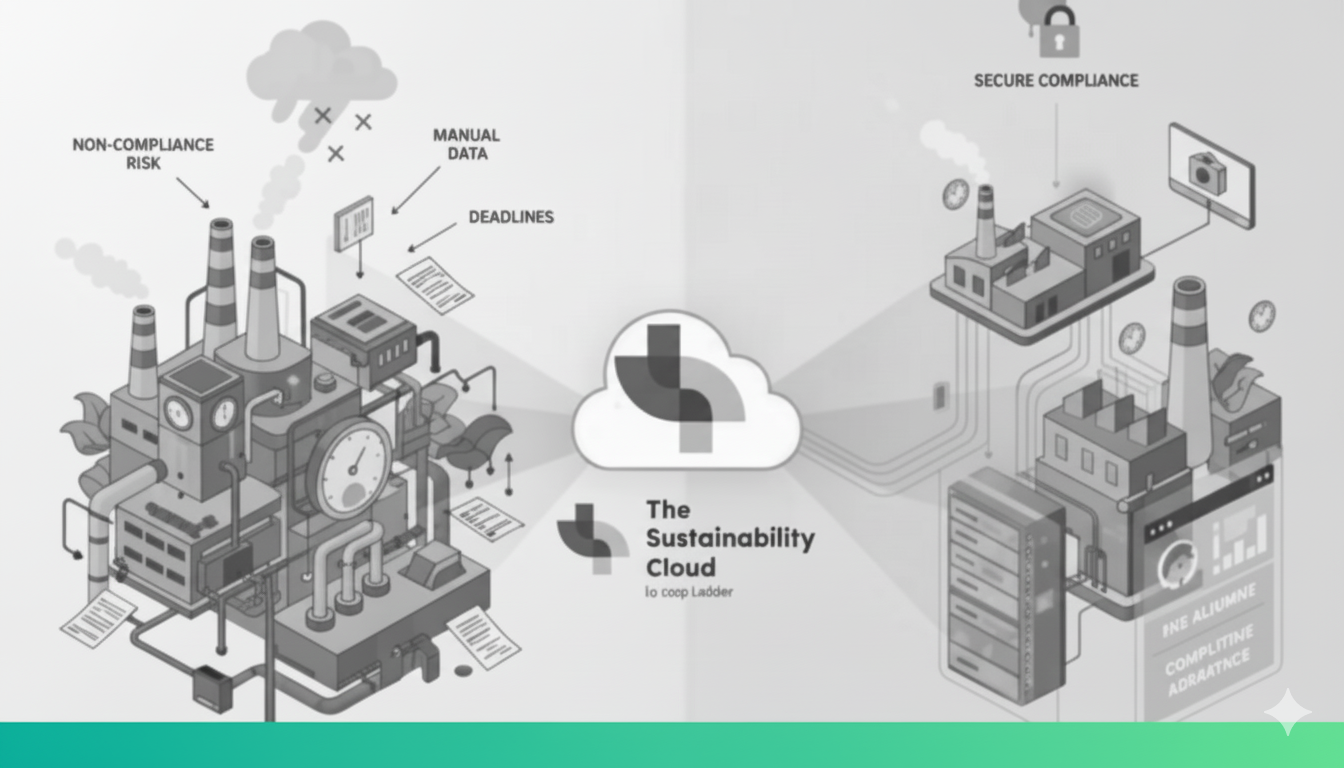

CPCB’s new Directive for NCR Delhi Industries: OCEMS PTZ Camera Installation

Delhi–NCR industries (food, textile, metal) must now install OCEMS and PTZ cameras with real-time data transmission to CPCB/SPCB servers, as per a new CPCB directive. Mandatory monitoring includes PM for all units, and PM + SO₂ + NOₓ for metal units, with full compliance required by 31 December 2025. The Sustainability Cloud offers end-to-end OCEMS + PTZ installation, integration, calibration, and upkeep to help industries become CPCB-compliant on time.

CBAM update: EU leaves Indirect Emissions out of scope for metals and scrap is now a separate product: Know more!

The European Union has released a critical CBAM update that reshapes how metal exporters will navigate the world’s most ambitious carbon-border mechanism. According to the latest announcements, the EU will

September 23, 2025 | CPCB Issues OCEMS Directive on Real-Time Emission Data

On 23 Sept 2025, CPCB directed industries to register on the new OCEMS portal for emission and data reporting. Learn what this means for businesses.

How to Become CBAM Audit-Ready Before 2026: Compliance with CBAM Solution

With CBAM’s transitional phase underway, EU-exporting installation operators must act now to ensure audit readiness. Full implementation begins in 2026—put robust CBAM tools in place to mitigate compliance risks early.

The Sustainability Cloud featured on Bharat Climate Startups

The Sustainability Cloud shared its journey on Bharat Climate Startups with host Shweta Dalmmia, highlighting its journey of building a platform that helps enterprises measure, report, and reduce their environmental footprint while charting a clear path to Net Zero.

CBAM Tax 2026: Act now to avoid massive penalties

The CBAM definitive regime begins January 1, 2026, making compliance mandatory. Non-compliance can trigger heavy CBAM tax penalties, blocked trade, and loss of market access. Discover how businesses can prepare with advanced CBAM tracking software.

CSO’s guide to top 5 best BRSR software platforms in 2025: Features and Comparison

The Business Responsibility and Sustainability Report (BRSR), mandated by SEBI demands ESG disclosures aligned with global standards. This blog lists down the top 5 BRSR reporting tools, an organization can trust upon for their BRSR reporting.

News and media

CPCB’s new Directive for NCR Delhi Industries: OCEMS PTZ Camera Installation

September 23, 2025 | CPCB Issues OCEMS Directive on Real-Time Emission Data