PCAF carbon accounting methodology provides financial institutions with a standardized framework to measure and disclose greenhouse gas emissions from loans and investments, helping you build transparency, manage climate risk, and meet regulatory requirements.

According to CDP research, financed emissions from financial institutions are on average over 700 times higher than direct operational emissions. With regulations like EU’s CSRD, California’s SB 253, and ISSB’s IFRS S2 mandating climate disclosures, implementing the PCAF (Partnership for Carbon Accounting Financials) carbon accounting methodology has become critical. Since the Paris Agreement, the world’s 60 largest banks have financed fossil fuels with $6.9 trillion, underscoring the sector’s massive climate influence.

What is PCAF Carbon Accounting Methodology?

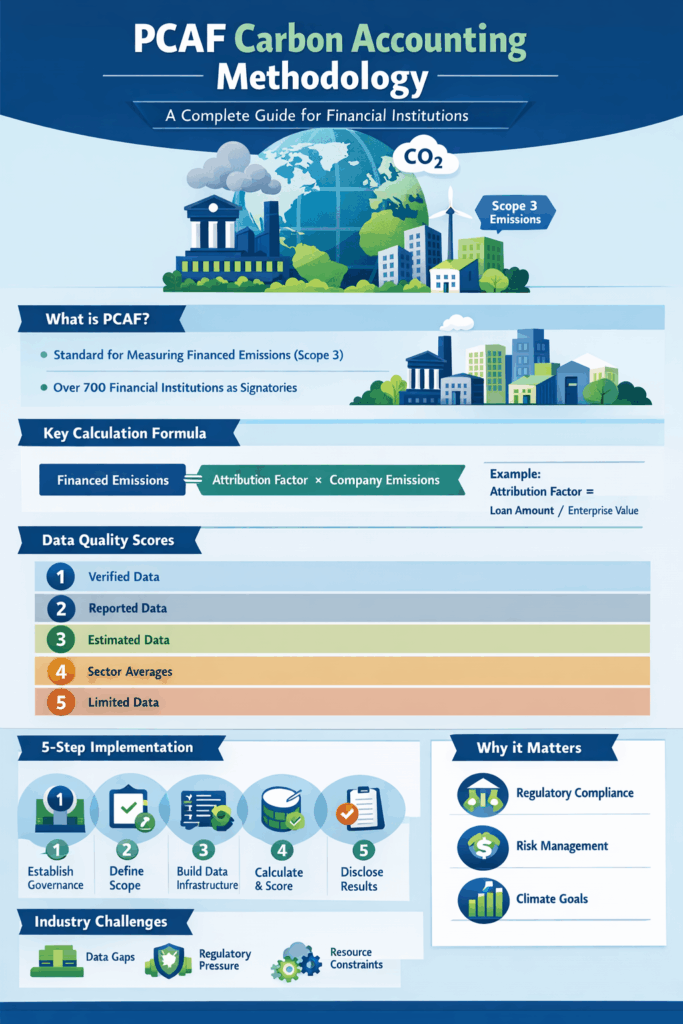

The Partnership for Carbon Accounting Financials developed the PCAF carbon accounting methodology, like the Global GHG Accounting and Reporting Standard for the Financial Industry. Founded in 2015, PCAF launched globally in 2019 and today provides the leading framework for measuring Scope 3 Category 15 emissions. Over 700 financial institutions have signed on as PCAF signatories, with more than 250 disclosures published, committing to measure and disclose financed emissions within three years.

The PCAF carbon accounting methodology evaluates financed emissions across three parts:

Part A: Financed Emissions – Seven asset classes including listed equity, corporate bonds, business loans, project finance, commercial real estate, mortgages, and motor vehicle loans.

Part B: Facilitated Emissions – Capital markets activities including underwriting and advisory services.

Part C: Insurance-Associated Emissions – Enables insurers to measure emissions from underwriting portfolios.

Why the PCAF Carbon Accounting Methodology Matters?

Financial institutions hold immense power over global emissions. Understanding the PCAF carbon accounting methodology is essential for:

- Regulatory Compliance: Aligns with TCFD, CSRD, CDP, SBTi, and ISSB requirements, enabling institutions to collect data once and reuse across frameworks.

- Risk Management: Provides critical metrics for assessing climate risks, identifying carbon-intensive exposure, and evaluating transition risks.

- Strategic Alignment: Enables science-based target setting and portfolio alignment with Paris Agreement goals.

- Stakeholder Trust: Transparent disclosure builds credibility with investors, regulators, and customers.

PCAF Carbon Accounting Methodology core calculation principles:

The PCAF carbon accounting methodology follows the fundamental formula: Financed Emissions = Attribution Factor × Company Emissions

The attribution factor varies by asset class. For listed equity and corporate bonds: Attribution Factor = Outstanding Amount / Enterprise Value Including Cash (EVIC).

This proportional approach allocates a company’s total emissions based on your institution’s financial exposure relative to the company’s total value.

Data Quality Scoring System

A distinctive feature of the PCAF carbon accounting methodology is its transparent 1-5 data quality scoring:

- Score 1: Verified reported emissions from investee/borrower (highest quality)

- Score 2: Unverified reported emissions from investee/borrower

- Score 3: Physical activity-based emissions using specific data

- Score 4: Economic activity-based emissions using average sector data

- Score 5: Economic activity-based emissions with limited data (lowest quality)

Institutions must calculate and disclose weighted average data quality scores across their portfolios, transparently communicating confidence levels to stakeholders.

PCAF Carbon Accounting Methodology 5-Step Implementation Framework

Step 1: Establish Governance

Sign the PCAF commitment letter and establish cross-functional teams covering finance, risk, ESG, and data management.

Step 2: Define Scope

Identify asset classes and prioritize based on materiality. Most organizations start with listed equity and corporate bonds before expanding to private holdings.

Step 3: Build Data Infrastructure

The PCAF carbon accounting methodology requires financial data (outstanding amounts, enterprise values), emissions data (company-reported GHG), and physical/economic data for estimation when direct emissions are unavailable.

Step 4: Calculate and Score

Apply the methodology for each asset class, following data quality hierarchies. Prioritize reported emissions, then physical activity-based, then economic activity-based estimates.

Step 5: Disclose

Generate transparent disclosures meeting CSRD, TCFD, CDP, GRI, and ISSB requirements with financed emissions by asset class, sector, and data quality scores.

PCAF Carbon Accounting Methodology Industry-Specific Pain Points

- Commercial Banking

Pain Points: Inability to quantify climate risk in loan portfolios, difficulty obtaining client emissions data, exposure to stranded assets in carbon-intensive sectors, complex regulatory requirements across jurisdictions.

Solution: The PCAF carbon accounting methodology enables credit risk assessment incorporating climate factors, supports sustainable lending product development, and facilitates systematic client engagement on emissions reduction.

- Asset Management

Pain Points: Investor pressure for climate-aligned portfolios, limited emissions data for private equity, challenges comparing emissions across diverse investments, potential portfolio restrictions from exclusions.

Solution: The methodology provides standardized portfolio-wide assessment, enables fund-level comparison, supports ESG integration, and facilitates development of net-zero aligned investment products.

- Insurance & Reinsurance

Pain Points: Underwriting climate risks without emissions visibility, regulatory pressure for insurance-associated emissions disclosure, client expectations for sustainable products, concentration risk in climate-vulnerable sectors.

Solution: Part C of the PCAF carbon accounting methodology quantifies emissions from underwriting activities, informs risk-based pricing decisions, and supports climate-resilient insurance product development.

- Private Equity

Pain Points: Limited emissions data from portfolio companies, complexity across diverse holdings, LP pressure for climate reporting, challenges with exit timing and data continuity.

Solution: The methodology enables consistent emissions reporting to LPs, supports ESG integration in investment decisions, and facilitates portfolio company improvement programs.

PCAF Carbon Accounting Methodology Key Implementation Challenges

- Data Availability: Only 25% of financial institutions disclosing through CDP reported portfolio emissions.

Solution: Start with available data, use PCAF’s emission factor database for estimates, and implement borrower engagement programs requiring emissions data.

2. Resource Constraints: Calculating emissions across large portfolios requires significant expertise.

Solution: Join PCAF regional teams for peer learning, access PCAF Academy training, and leverage technology platforms.

3. Methodological Complexity: Different asset classes require different approaches.

Solution: Follow PCAF’s detailed methodologies, use specialized software to automate calculations, and document decisions for audit defensibility.

4. Evolving Standards: Regulations vary across jurisdictions.

Solution: The PCAF carbon accounting methodology serves as the common backbone across frameworks. Build flexible data infrastructure adaptable to changing requirements.

PCAF Carbon Accounting Methodology Technology Solutions

Traditional spreadsheet approaches are unscalable. Modern platforms automate data collection through API integrations, provide pre-built calculation logic for all PCAF asset classes, offer real-time portfolio analytics, and generate automated disclosure templates. Leading institutions report 60% reduction in calculation cycle time and 75% faster regulatory reporting.

The PCAF carbon accounting methodology has transformed from voluntary best practice to business imperative. Organizations implementing robust programs gain competitive advantage through enhanced risk management, regulatory readiness, and strategic positioning in sustainable finance markets.

Mastering the PCAF carbon accounting methodology today positions financial institutions as climate leaders tomorrow, measuring, disclosing, and actively managing their contribution to global emissions while mobilizing capital toward sustainable solutions. Regulations such as PCAF might sound huge at first, but deploying relevant technologies and software like The Sustainability Cloud, can help automate the entire process right from data collection to emission disclosure. As world transforms from manual efforts to software to AI-native platforms, organisations must choose a climate tech suite which offers services that keeps them ahead of the competition, especially in the sector like finance and banking.