For importers of carbon-intensive products into the EU, the Carbon Border Adjustment Mechanism (CBAM) represents significant regulatory practices and compliances. Designed to ensure a level playing field between EU producers and their international counterparts, CBAM addresses carbon leakage by imposing a carbon price on specific imports. Under this regulation, non-EU exporters must enter the EU through EU importers, making them critical touchpoints for trade. As CBAM rolls out, importers must navigate a complex and evolving landscape of compliances, transitioning from the 2023-2025 Transitional Phase into the Definitive Regime starting in 2026.

An extension of EU ETS, CBAM is part of the EU’s efforts to achieve objectives outlined in its green agenda to tackle the issue of relocating emission-heavy production to countries with less stringent environmental policies. During the two phases of CBAM implementation, importers must meticulously track, report, and verify emissions data, ensuring adherence to stringent EU standards. Understanding and fulfilling these compliance obligations is crucial for importers to avoid penalties and maintain smooth operations within the EU market.

In this blog, we address key guidelines, obligations and compliances for importers under the CBAM mechanism.

Who are importers ?

EU CBAM importers are people or entities stationed in the European Union who import CBAM products from exporters outside the Commission. They play the most crucial role in the ecosystem within which the CBAM functions. The importer is strictly obligated to report the embedded emissions data shared by exporters outside the EU for products from cement, iron and steel, aluminium, fertilisers, hydrogen and electricity sectors only. The list of the sectors is expected to expand at a later stage.

The importer is also referred to as the ‘reporting declarant’, who is responsible for reporting the embedded emissions of imported goods.

How to fill CBAM communication template?

The last quarterly report of CBAM for the period October to December 2025 is due to be submitted to the CBAM Transitional Registry by 31 January 2026. CBAM reporting can be complex for EU importers, however, being mindful of specific parameters before filing the CBAM report can streamline the process. Here’s a look at 7 factors to keep in mind:

Carbon emissions report:

Importers must submit quarterly carbon emission and embedded emission reports for exporters outside the Commission. The importer should ensure these reports include comprehensive data on indirect, direct, and embedded emissions and precursor information.

Carbon tariff:

The importer should also pass on the information about the carbon tax paid in the country of origin by the exporter to avoid being levied a double tax. If a certain amount of carbon tax is already paid by the operators in the country of origin, then the carbon prices to be paid by the importers for the particular product can be adjusted to ensure price equivalence.

Data accuracy:

The importer should aim to report the emissions data as accurately and thoroughly as possible despite the fact that there is no mandatory data verification requirement during Transitional Phase 1. Meanwhile, importers can use the default value given by the European Union under the CBAM rules for reporting purposes only during Transition Phase 1.

Also Read: 5 Best practices for EU importers to ensure data accuracy

Book-keeping by importers:

The importer could install tools to generate a list of imported goods under the CBAM. This might be done automatically by book-keeping software. The importer is also recommended to make disclosure of information about CBAM products’ emission data in the purchase contract with the exporter. The importer can request emissions data in any suitable format complimentary to the CBAM reporting parameters.

Reporting period for importers:

The reporting period for importers is quarterly. These quarterly reports are required to give a summary of embedded emissions in goods imported into the EU. Moreover, the importer should have clearance by the customs authorities for all the imported products.

Latest data by importers:

The reporting declarant or importer must use the latest embedded emissions data communicated to them by installation operators for their quarterly CBAM reports.

Also Read: One year of CBAM reporting for exporters: Key learnings and lessons

Reporting responsibilities for importers during Transitional Phase 1

During the transition period of CBAM implementation, importers primarily have to focus on learning more about the guidelines applicable to them and the stakeholders related to them. They must undertake a detailed study of CBAM guidance documents and templates given by the EU for reporting purposes. During the transitional period, no data verification and no payment of financial adjustment for embedded emissions are required. Here is a look at some reporting requirements:

- Quantity of imported goods

- Mandatory quarterly reporting of embedded emissions

- Voluntary disclosure of carbon tax certificate

- Use of EU’s default value for reporting emissions

However, the above compliances are set to become mandatory in the definitive regime of CBAM.

Reporting responsibilities for importers during the Definitive Regime

During the definitive regime, all the reporting obligations and responsibilities become mandatory. The commission can impose stricter penalties on importers for any discrepancies in the reporting process. Here is a look at some reporting duties:

- Accurate reporting of emissions data

- Purchase of CBAM certification

- Compulsory surrendering of CBAM certificates

- Verification of reported emissions data

Unlike the Transition Phase 1, during the Definitive Phase, the importer can not use the default values for emission reporting. In addition, they will be subject to penalties for delayed or non-financial adjustments of carbon tax.

List of disclosures for importers under CBAM

Importers must register and access the CBAM Transitional Registry for CBAM reporting. The registry is restricted to reporting declarants, competent authorities, customs authorities, and the European Commission. Here are some of the disclosures importers are expected to disclose in the registry:

Reporting:

An importer is responsible for lodging a customs declaration in his own name and account for the release of goods for free circulation in adherence to customs law, as per Article 2 of the CBAM Implementing Regulation (EU) 2023/1773.

Installation details:

The importer must also provide information on the type of goods identified by their CN code and the origin country of the imported goods. The reporting declarant must also know about the installation where the goods were produced and the exact geographical coordinates of the exporter outside the EU.

Production routes information:

The reporting declarant must know about the production routes used (technology used for producing products) for the products. This has to be in line with the definition of Section 3 of Annex II of this regulation.

Emission factor:

Importers must report the emission factor for electricity consumed by the imported products during their production, as per Section D of Annex III of the Regulation. This will also mean specifying whether the default values given by the EU have been used for reporting the embedded emissions during the transitional period.

Additional information:

A reporting declarant must submit multiple additional information for clearance of imported products. An importer must be aware of the methodology used for collecting emissions data, the level of accuracy, system boundaries, production processes monitored, emission factors and other methods employed for the calculations and reporting.

Also Read: CBAM rules: How importers need to file their CBAM report

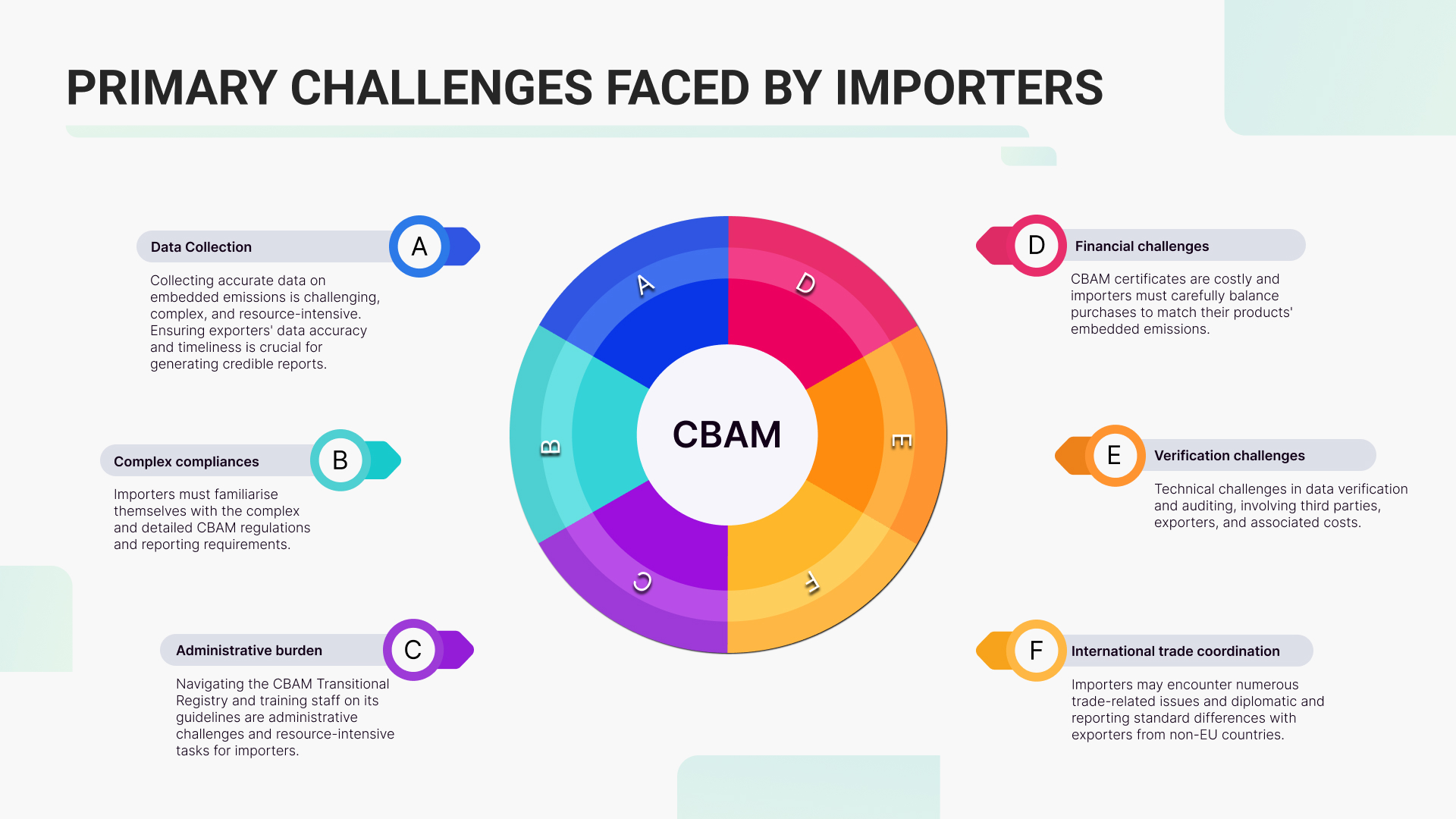

Primary challenges faced by importers

An importer faces multiple challenges while implementing CBAM guidelines, obligations, and compliances during Transitional Phase 1 and the Definitive Regime. Overall, importers face a multi-faceted set of challenges under CBAM, involving regulatory compliance, financial management, data accuracy, and international coordination. Effective preparation and resource allocation will be crucial to successfully navigating these challenges.

4 qualities that can ensure swift CBAM reporting for EU importers

There are some general requirements and parameters that need to be followed by the importer to be able to start the reporting and monitoring process. Here is a look at them:

Compliance with NCA:

The CBAM reporting liabilities are upon the importers or the reporting declarant. The National Competent Authority (NCA) can impose penalties on the importer provided that the reporting declarant fails to comply with the CBAM regulations. The importer is responsible for lodging a customs declaration for the release and free circulation of goods in its own name and on his behalf. The importer has an authorisation to lodge a customs declaration and declares the importation of goods.

Accurate information:

The CBAM reporting declarant has to submit details contained in Annex I to the Implementing Regulation. The long list of information to be submitted by the importer has details such as reporting period, year, competent authority signatures, commodity details, emissions data, etc. The importer must follow the communication template given by the commission during the period of gathering relevant data from exporter sitting outside the country.

Collaboration between importers and exporters:

Importer and exporter sitting outside the EU must have a strong collaboration with respect to official communication to ensure fulfilment of all reporting requirements. Importers must ensure that non-EU operators follow the templates and guidance published by the Commission while determining embedded emissions since the reporting declarant is the one who bears the responsibility for ensuring the completeness and correctness of the CBAM reports.

Follow Union Customs Code for returned goods:

During the transitional period, reporting obligations do not apply to “returned goods” as defined in Article 203 of the Union Customs Code. This means their embedded emissions need not be included in quarterly CBAM reports. However, for returned goods defined in Article 205, which were re-exported after inward processing, the reporting obligations remain. In the definitive period, importers must report Article 203 returned goods in the annual CBAM declaration with zero embedded emissions, while Article 205 goods must be reported like any other CBAM imports. These provisions apply only to goods of non-EU origin and goods of EU origin are exempt from CBAM.

Modified goods relation with inward processing:

Under the Carbon Border Adjustment Mechanism (CBAM), a “modified good” refers to a product that has undergone significant changes after being imported into the EU. These modifications can include processes that alter the product’s nature, enhance its value, or substantially change its state.

The classification of goods as “modified” under CBAM impacts the calculation of embedded emissions and compliance reporting, as these goods might need to be reported differently than unmodified imports. This ensures accurate tracking of carbon emissions associated with products that have been significantly altered after their initial import.

Inward processing involves importing goods into the EU for processing with suspension of import duties and VAT. After processing, the goods can be either re-exported or released for free circulation within the EU. This process is closely associated with both modified CBAM goods and modified non-CBAM goods. Article 6 of the Implementing Regulation outlines special reporting requirements for goods released for free circulation after inward processing for the quarterly CBAM reports.

- If the goods are modified during inward processing and no longer qualify as CBAM goods, the report must still include the quantities and embedded emissions of the original goods. Additionally, the report should include the country of origin and the production installations, if known.

- If the goods are modified during inward processing and remain CBAM goods, the report must include the quantities and embedded emissions of the goods released to the market. The report should additionally include the country of origin and production installations, if known.

What is the way forward for importers?

The primary challenge for importers lies in maintaining effective communication and official collaboration with non-EU operators to ensure smooth CBAM compliance. Importers must ensure the accuracy of emissions data submitted by exporters and trace back details of the manufacturing origins in non-EU countries. Additional difficulties arise in determining actual emissions, leading to credibility issues regarding data shared by operators.

To successfully navigate CBAM compliance, importers must gather, manage, and process a substantial amount of emissions information from exporters outside the EU. This necessitates digitising the entire data management process to achieve efficient outcomes and high-level data accuracy. Most challenges faced by importers can be mitigated by utilising comprehensive solutions such as The Sustainability Cloud, which offers an all-in-one platform to address issues related to CBAM compliance. Its comprehensive CBAM reporting tool allows enterprises data collection, embedded emission calculations, reporting and auditing to ensure compliance.

Also Read: 6 questions every declarant needs to ask before selecting a CBAM importer tool

FAQ

The CBAM Regulation applies to all goods that are imported into the EU, namely released for free circulation in the EU single market.

Returned goods are goods defined in Article 203 of the Union Customs Code (Regulation (EU) No 952/2013). They are goods that are released for free circulation and benefit from duty exemption because they were Union goods before, either because they have originally been exported as Union goods or because they were previously released for free circulation, and because they fulfil certain conditions (e.g. they are released for free circulation within three years after they were previously exported). The conditions under which those goods qualify as returned goods are laid down in the customs legislation, and competent customs authorities assess whether these conditions are fulfilled when the goods are declared for release for free circulation in the EU.

During the transitional period, CBAM reporting obligations do not apply to returned goods as defined in Article 203 of the Union Customs Code. As a result, the embedded emissions of these goods do not need to be included in the quarterly CBAM report. However, for returned goods as defined in Article 205 of the Union Customs Code, the reporting obligations are not waived. Article 205 applies to returned goods which were originally re-exported after having been placed under inward processing.

During the definitive period, reporting declarants will have to report returned goods as defined in Article 203 of the Union Customs Code in their annual CBAM declaration, however they must input ‘zero’ for the total embedded emissions corresponding to those goods. For returned goods as defined in Article 205 of the Union Customs Code, the declarant must report the embedded emissions like for any other import of CBAM goods.

The above provisions on “returned goods” only apply to goods of non-EU origin. Conversely, for goods which are of EU origin (according to the rules of origin) when they are returned to the Union, no CBAM applies.

Liability lies with the reporting declarant. This may be either the importer or the indirect customs representative. The NCA is responsible for engaging in the appropriate dialogue with the reporting declarant and may impose penalties.

The importer is free to use different indirect customs representatives, each being accountable for the specific CBAM goods that they have introduced in their customs declaration. Each representative will show their own EORI number at the customs, which is the evidence of who is responsible for the CBAM reporting obligation. Therefore, there can be no double-counting of embedded emissions.

An indirect customs representative can also carry out the CBAM reporting obligation and act as reporting declarant for multiple importers. In such case, the indirect customs representative must still submit one single quarterly CBAM report containing all the CBAM goods for which he has carried out the customs declaration. He cannot submit several quarterly CBAM reports for a single reporting period.

A good cooperation between third-country producers and reporting declarants is crucial. The Commission has published guidance and templates to help producers determine embedded emissions of the goods they produce. Ultimately, the reporting declarant is the one who bears the responsibility for ensuring the completeness and correctness of the CBAM reports. The reporting declarant is liable and may be subject to penalties in the case of non-respect of the CBAM reporting obligations. • During part of the transitional period (until mid-2024), declarants may rely on default values, which are further elaborated on in the question “What are the default values? How does this work?”.