5 Tactics To Outpace Peers in Scope 3 Emissions Reporting

The world’s carbon markets are evolving rapidly, and India’s carbon market is also expected to launch by 2026, with a carbon credit trading scheme in place by the government already.

The world’s carbon markets are evolving rapidly, and India’s carbon market is also expected to launch by 2026, with a carbon credit trading scheme in place by the government already.

Scope 3 emissions, representing indirect activities like business travel and product use, account for up to 70% of a company’s carbon footprint. Tracking these emissions is challenging due to inconsistent data. Robust Scope 3 emission software helps businesses turn fragmented data into actionable insights, offering both strategic and environmental benefits.

Discover how carbon accounting in India can unlock lucrative carbon markets, enhance business sustainability, and ensure compliance with emerging regulations. This blog looks at why now is the time to start measuring your carbon footprint!

Climate change has started to impact businesses, communities and organisations in their day-to-day operations. Hence, the world has focused on developing and implementing their country-specific NetZero goals.

Discover 5 extremely important tips to master business carbon accounting from data integration to software selection.

As global trade considers embedded carbon, accurate carbon accounting is vital for compliance and continuity. Manual methods risk errors and inefficiencies, while software solutions streamline tracking, ensuring precise emissions reporting and regulatory compliance.

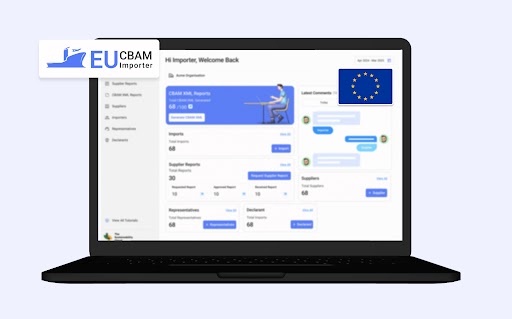

Crafted for CBAM declarants, the software is designed to provide easy CBAM reporting solution for the EU’s €6.57 trillion import market.

The Carbon Border Adjustment Mechanism has completed over 1 year of ongoing Transitional Phase 1 implementation. This Phase has been particularly challenging for businesses and companies as most of them continue to adapt to CBAM. In this blog, we will discuss key learnings from CBAM implementation.

EU importers need a CBAM reporting tool to eliminate multiple challenges related to quarterly report generation. The right evaluation of CBAM software depends on factors such as complexities, data collection and accuracy, among others. A look at 6 questions to consider while evaluating the CBAM reporting tool for importers.

CBAM is one of the most complex compliances, and everyone is new to this ecosystem. Nobody has any past experience in CBAM reporting. Hence, starting CBAM reporting gives you a competitive advantage and keeps you ahead of other players in the market. In this blog, we will understand 4 reasons why you should start early CBAM reporting:

Our website uses cookies which are necessary for running the website and for providing the best experience. We would also like to set optional cookies on your device. Not consenting or withdrawing consent, may adversely affect certain features and functions.

EU CBAM solution for Importers is now live! - Sign up to get 40% off 🎉