Latest Post

A practical 10-step guide to navigating CCTS India

The Carbon Credit Trading Scheme also known as CCTS India, involves multiple steps engagement with various stakeholders at every stage.

The hidden challenges facing ESG in Saudi Arabia—and how to overcome them for Vision 2030

Saudi Vision 2030 is reshaping the Kingdom’s future—with ESG in Saudi Arabia at its core to drive sustainability, accountability, and

A practical 10-step guide to navigating CCTS India

The Carbon Credit Trading Scheme also known as CCTS India, involves multiple steps engagement with various stakeholders at every stage.

The hidden challenges facing ESG in Saudi Arabia—and how to overcome them for Vision 2030

Saudi Vision 2030 is reshaping the Kingdom’s future—with ESG in Saudi Arabia at its core to drive sustainability, accountability, and

Featured Post

What is Carbon Footprint and how to reduce it?

For your information, the earth’s temperature has fairly remained constant for a long time

Is Energy efficient retail segment a myth or possibility?

Until the early 2000’s anyone in the retail segment talking about energy efficient stores

Must know CBAM reporting rules for aluminium and electricity sectors

An outline of CBAM rules and regulations for products under the aluminium and electricity

CBAM Reporting: Steps to request delayed CBAM report submissions

Importers and exporters facing issues in submitting the quarterly CBAM reports can now request

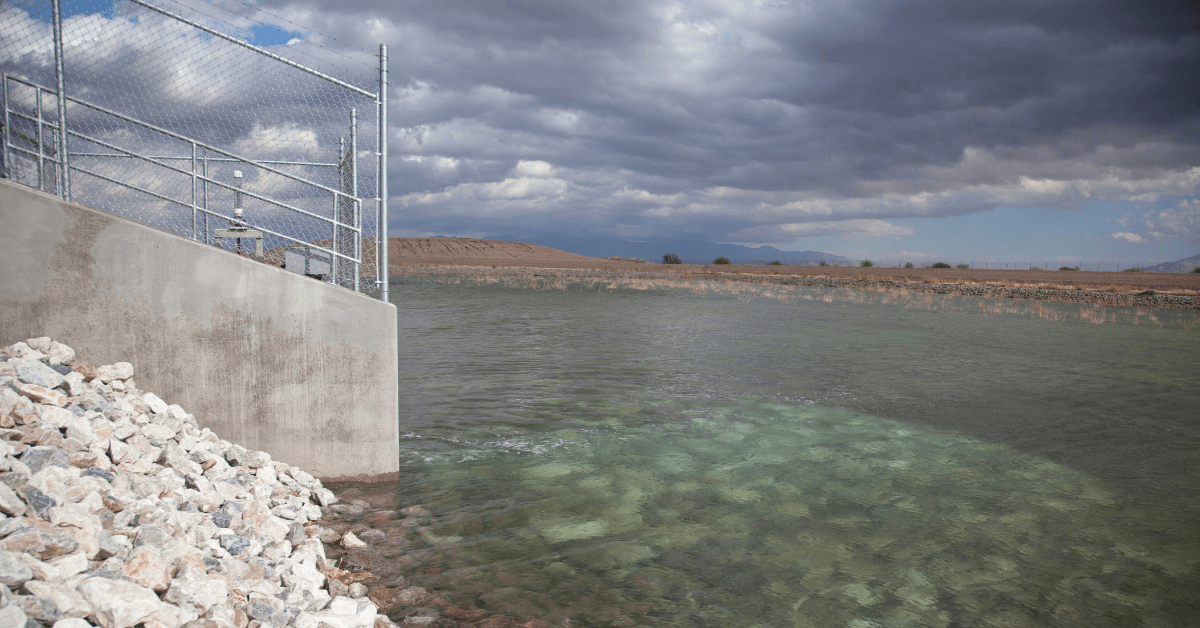

Artificial Recharge of Groundwater

The growing demand for groundwater due to the ever-rising global population has encouraged us

UV-VIS Spectrophotometry for Online Effluent Monitoring (COD, BOD, and TSS)

Every living thing on earth needs water to survive. Human bodies are made up

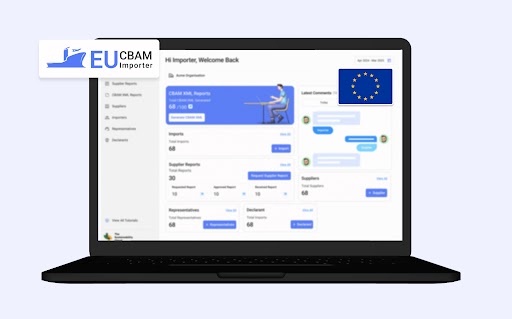

6 questions every declarant needs to ask before selecting a CBAM importer tool

EU importers need a CBAM reporting tool to eliminate multiple challenges related to quarterly

6 Best sustainability management practices

A look at the best sustainability management practices that businesses need to pay more

Common mistakes to avoid while using a Carbon Accounting software

As global trade considers embedded carbon, accurate carbon accounting is vital for compliance and continuity. Manual methods risk errors and inefficiencies, while software solutions streamline tracking, ensuring precise emissions reporting and regulatory compliance.

How EU importers’ reluctant compliance to CBAM is reshaping trade and revenue

EU importers are experiencing the administrative and economic impacts of the Carbon Border Adjustment Mechanism. In this blog, we will do a deep-dive analysis of how CBAM will impact your business as an importer in the EU.

The ultimate beginner’s playbook for Carbon Accounting for companies

Carbon accounting plays an important role in reducing the environmental impact of any company to help it achieve NetZero targets. Here is all you need to know about carbon accounting.

Omnibus package: Know new CBAM report filing and CSRD rules

With the introduction of the Omnibus package, global trade will witness changes and to some extent relief when it comes to CBAM reporting. It will certainly disrupt the supply chain, but not act as a hindrance to trade flows.

The Sustainability Cloud simplifies CBAM reporting for declarants in EU

Crafted for CBAM declarants, the software is designed to provide easy CBAM reporting solution for the EU’s €6.57 trillion import market.

One year of CBAM reporting for exporters: Key learnings and lessons

The Carbon Border Adjustment Mechanism has completed over 1 year of ongoing Transitional Phase 1 implementation. This Phase has been particularly challenging for businesses and companies as most of them continue to adapt to CBAM. In this blog, we will discuss key learnings from CBAM implementation.

6 questions every declarant needs to ask before selecting a CBAM importer tool

EU importers need a CBAM reporting tool to eliminate multiple challenges related to quarterly report generation. The right evaluation of CBAM software depends on factors such as complexities, data collection and accuracy, among others. A look at 6 questions to consider while evaluating the CBAM reporting tool for importers.

How early CBAM reporting for declarants and suppliers can protect and boost profits

CBAM is one of the most complex compliances, and everyone is new to this ecosystem. Nobody has any past experience in CBAM reporting. Hence, starting CBAM reporting gives you a competitive advantage and keeps you ahead of other players in the market. In this blog, we will understand 4 reasons why you should start early CBAM reporting:

Top 5 must-have features of an ESG management software

ESG, which stands for Environmental, Social and Governance, has been gaining unprecedented significance over the past few years. The surge in ESG policies and regulations also means increasing demand for ESG reporting platforms in India and abroad. Here are the top features that every CSO must remember when selecting an ESG reporting tool.

News and media

YOURSTORY | This Sustainability Cloud startup is helping companies track their carbon footprint