In today’s rapidly evolving ESG landscape, organisations face increasing pressure from stakeholders to comply with diverse reporting expectations, while conducting materiality assessments—both impact and financial—in alignment with multiple standards and frameworks such as GRI, CSRD, IFRS S1 and S2, SASB, and CDP.

Amidst this complexity, some may question whether legacy standards like the Global Reporting Initiative (GRI) still hold their ground, popularity and significance.

The answer is a resounding “YES”.

Founded in 1997, following the public outcry over the environmental damage caused by the Exxon Valdez oil spill, the Global Reporting Initiative operates as an international, independent organisation. It creates common accounting mechanisms, such as frameworks and standards, for companies worldwide to adhere to ESG guidelines. GRI remains the most widely used ESG reporting standard globally, trusted by 10000+ companies in over 100+ countries to communicate their environmental, social, and governance impact transparently.

Its foundation in impact materiality assessment sets it apart from frameworks that focus solely on financial materiality. Ideally, companies should draw from both perspectives – impact and financial – to ensure they are reporting not only what affects them, but also what they affect.

This blog explores the enduring strengths of GRI, why it continues to be the go-to choice for both seasoned ESG professionals and business leaders, and how it empowers organisations to convert their materiality assessments and sustainability performance into meaningful global impact.

What do you mean by GRI?

Global Reporting Initiative has long stood at the forefront of sustainability reporting, trusted by organisations around the globe. It is recognized for its comprehensive, multi-stakeholder approach that prioritizes transparency, accountability, and real-world impact. At the heart of the framework’s philosophy lies a fundamental question:

How does your organisation impact the economy, the environment, and society?

This question has guided thousands of companies in building not just sustainability reports, but credible, responsible, and stakeholder-aligned strategies, translating into organisational growth and a better reputation.

Also Read: ESG reporting in KSA: Is it time to ditch traditional ESG consulting?

Why do companies use GRI?

GRI’s relevance and global adoption can be traced to its foundational strengths:

1. Longevity and Established Trust

GRI pioneered the concept of sustainability reporting close to three decades ago and has continually updated its standards in line with international best practices. They have continually updated their reporting standards in line with the rapidly changing global business and environment landscape. Its long-standing presence has built deep trust with businesses, governments, and civil society organizations.

2. Multi-Stakeholder Focus & Impact Materiality

The framework’s standards are built for all stakeholders—including employees, communities, customers, regulators, and investors. They are based on impact materiality.

Impact materiality (inside-out) is the lens through which organisations assess and communicate how their operations affect the world around them, including society, the environment, and the economy.

In Saudi Arabia, Cement is one of the most carbon-intensive sectors due to the scale of infrastructure development under Vision 2030. Companies like Saudi Cement or Yamama Cement could assess their actual impacts through energy-efficient kilns and carbon capture investments, and their potential positive influence by leading industry-wide decarbonisation efforts in the Gulf Cooperation Council (GCC) region.

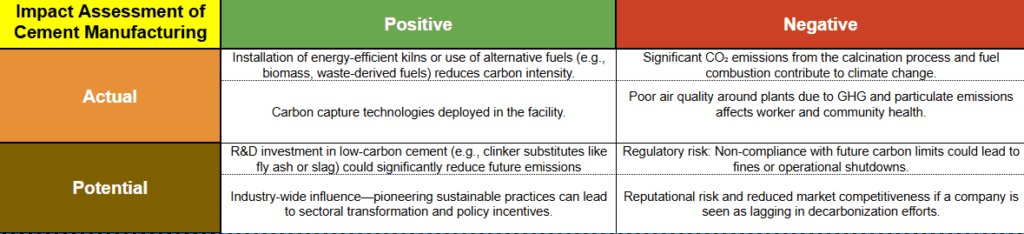

For example: Let’s take GHG emissions in the manufacturing of cement and conduct an impact assessment:

3. Free, Public, and Modular Framework

The framework’s standards are available as a free public good, enabling organisations of any size and sector to participate. Its modular design allows for flexibility and scalability, making it practical for both global enterprises and local organisations.

This flexibility is especially beneficial for SMEs and family-owned businesses in Saudi Arabia’s non-oil sectors, such as logistics, tourism, or food processing, who are beginning to align with national sustainability goals but may lack the resources for expensive ESG consultancy.

4. Global Reach and Alignment

As of 2024, GRI is the most widely used sustainability reporting standard in the world, with 73% of the world’s 250 largest companies adopting it. It continues to be the most widely used across all regions: Asia-Pacific (75%), Europe (71%), Americas (70%), and Middle East & Africa (64%).

This widespread usage reflects the ESG framework’s adaptability to regional expectations and regulatory landscapes.

Saudi Arabia’s Public Investment Fund (PIF), which backs large-scale projects like NEOM and The Line, increasingly integrates sustainability performance into investor reporting. Using GRI-based disclosures could help companies seeking PIF support demonstrate alignment with both impact goals and Vision 2030’s economic diversification targets.

Also Read: The hidden challenges facing ESG in Saudi Arabia—and how to overcome them for Vision 2030

5. GRI is the bridge to attaining United Nation Sustainable Development Goals (UNSDGs)

A key strength of the Standards is their clear alignment with the UN Sustainable Development Goals (UNSDGs). In fact, their roots lie in several non-profits, one such being UNEP.

UNSDGs reporting becomes easier with GRI’s ESG framework. It offers a structured framework that maps its disclosures directly to the 17 SDGs and their underlying targets, making it easier for companies to measure, track, and communicate progress.

For instance, companies in Saudi Arabia’s rapidly growing renewable energy sector such as those participating in the Sakaka Solar Plant or Red Sea Wind initiatives can use the framework to report progress on SDG 7 (Affordable and Clean Energy) and SDG 13 (Climate Action) while aligning with the Kingdom’s Net Zero by 2060 vision.

This structured approach is particularly valuable when reporting to multiple stakeholders.

Here are some examples:

- How GRI Supports Leadership and Strategic Alignment

Business leaders who like to quantify risk impacts and identify early opportunities will find the framework’s impact materiality approach very useful.

Substituting cobalt in EVs is a good example. Converting agricultural waste to biofuels and then using it as an alternative fuel is a great example of community impact that a business can make.

Selling such biofuels as a new product presents an opportunity to capitalise on emerging trends.

A leading dairy company in KSA, such as Almarai, use the standard to assess the environmental impact of water usage and emissions in livestock farming turning sustainable feed innovations and waste-to-energy technologies into both risk mitigation and new product lines.

Also Read: Top 5 must-have features of an ESG management software

GRI’s role in global ESG benchmarking

The standard’s framework-based disclosures also contribute to external benchmarks that evaluate companies’ social and environmental impact. A notable example is the World Benchmarking Alliance (WBA), which uses GRI-aligned data to assess corporate performance.

By aligning with the framework, companies enhance their visibility in public ESG rankings and demonstrate leadership on key global development issues.

Unlocking a more sustainable future with GRI

The standard continues to be the most widely adopted ESG reporting standard, recognized for its impact-based disclosures, SDG alignment, and relevance across global stakeholder groups.

The Sustainability Cloud (TSC) is pre-configured to align with GRI Standards, simplifying and accelerating the entire ESG reporting process. Once the materiality assessment is completed, TSC enables organizations to:

- Access pre-mapped metrics relevant to their material topics

- Automate and consolidate data input through structured templates—monthly, quarterly, or yearly—using API integrations with systems like ERP, SAP, and others

- Assign data ownership to responsible POCs with automated reminders, ensuring accountability and traceability

- Use interactive dashboards to analyze and filter ESG data by facility, time period, topic, or ESG pillar

- Eliminate reliance on fragmented spreadsheets, reducing manual effort and freeing up teams to focus on strategy and mitigation

TSC also ensures clear audit trails, with the ability to invite auditors to verify documents online or export reports directly in GRI-compliant format—enhancing both transparency and efficiency. For organisations in the KSA just beginning their ESG journey, TSC can help streamline reporting by aligning directly with national platforms such as the Saudi Green Initiative’s reporting mechanisms or Aramco’s supplier sustainability criteria.