The Kingdom of Saudi Arabia is undergoing a profound transformation under Vision 2030 and the Saudi Green Initiative, with sustainability at the core of national progress. The frameworks under these policies emphasise transparency, innovation, and resilience, all of which closely aligns with Environmental, Social, and Governance (ESG) principles. As ESG reporting in KSA gains momentum, driven by national mandates like the Capital Market Authority’s (CMA) requirements and the Saudi Exchange’s ESG Disclosure Guidelines, businesses are under increasing pressure to report accurately, efficiently, and in line with global standards such as GRI, IFRS, and Scope 1 & 2 emissions.

To support this shift, initiatives like the Sustainability Champions Program, launched by the Ministry of Economy and Planning, are rallying industry leaders to embed ESG into their core strategies and accelerate progress toward the UN Sustainable Development Goals (SDGs). This is to increase green investments, enhance market standing to participate in the global sustainability market and align with UN Sustainable Development Goals (SDGs).

In this evolving landscape, the question emerges: Should companies rely on traditional ESG consulting models or embrace digitized ESG reporting platforms to meet these new expectations?

Also Read: The hidden challenges facing ESG in Saudi Arabia—and how to overcome them for Vision 2030

This blog explores the strengths and limitations of both approaches and helps you identify the right path for effective ESG reporting in KSA.

How do you approach ESG reporting?

Should they follow a traditional consultant-driven path or adopt a digitally enabled, consulting-integrated ESG approach?

ESG reporting in KSA is in a developing stage with many Saudi companies requiring guidance, structure, and support. While traditional ESG consulting offers expert-driven insights, it often lacks long-term scalability and in-house capability building.

On the other side, digitally driven ESG consulting platforms offer a hybrid model: combining expert advisory services with powerful software tools. This empowers internal teams, ensures accuracy, and creates a transparent, traceable, and auditable ESG reporting process aligned with both local and global standards.

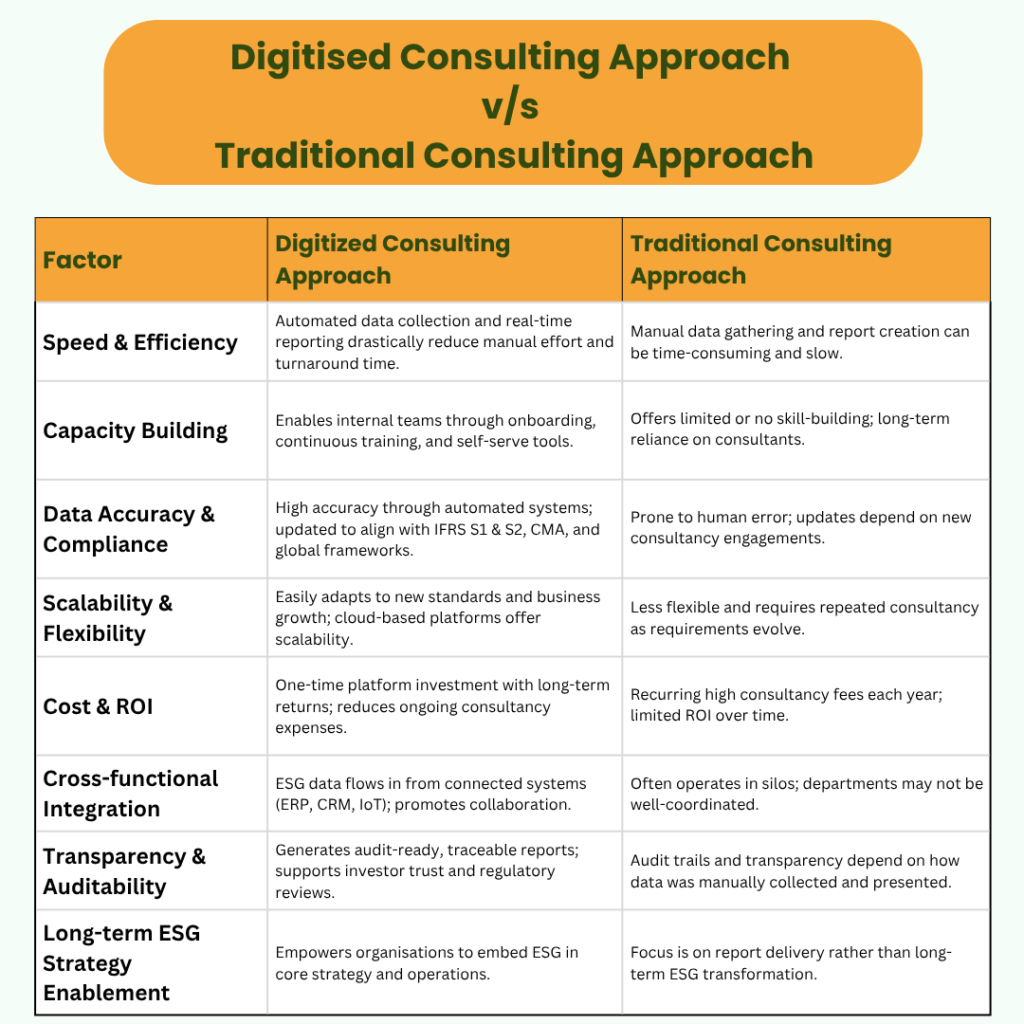

Comparing the Two Approaches

Scenario 1: ESG Reporting with a digitally led consulting approach

In the era of digital innovation, ESG reporting in KSA has transcended traditional methods. Digitally led consulting approaches are revolutionising how organisations approach ESG by embedding advanced technologies with expert guidance. There are various advantages of this approach:

1. Accelerated Reporting process: Instead of spending countless hours manually structuring data, calculating emissions, and consolidating reports, ESG teams can focus on strategy and impact. An ESG Platform handles real-time data collection, digitisation, and analysis, while seamlessly integrating into an organisational current software, such as ERP, CRM, etc. This enables the organisation to focus more on strategy building instead of doing redundant tasks.

2. Capability Building: ESG software and platforms often provide onboarding and continuous training for internal teams to understand ESG concepts, data input requirements, and frameworks. These trainings build the capacity of the employees to manage ESG data in-house, reducing dependency on external parties over time.

3. Enhanced Data Accuracy and Compliance Automated systems minimise human errors, ensuring accurate and consistent data. This precision is crucial for compliance with evolving regulations such as the IFRS S1 & S2 standards, and the Saudi Capital Market Authority’s ESG guidelines.

4. Real-time updates and Flexibility: As per a PwC study, Cloud-based platforms are regularly updated to reflect the latest ESG frameworks and regulations, providing organisations with the agility to adapt swiftly to new requirements and gain a competitive edge in the compliance landscape.

5. Cost Efficiency and ROI: Investing in ESG reporting software yields substantial returns. A Deloitte study highlights that digital transformation in ESG reporting can help companies not only comply with new requirements but also unlock new revenue streams and improve efficiencies.

For Example:

XYZ Manufacturing, a mid-sized industrial firm in Riyadh, adopts a digital ESG platform integrated with consulting support.

- They use an ESG reporting software to automatically collect emissions data from their IoT-connected machinery.

- The ESG dashboard gives real-time updates aligned with IFRS S1 & S2 and Saudi CMA guidelines.

- Employees are trained through the platform’s onboarding modules, allowing them to build capacity.

- The software generates audit-ready reports, making it easier to attract ESG-focused investors and participate in international tenders.

Outcome:

Organisation saves time, builds internal ESG capacity, ensures compliance, and can also attract major green investments. Additionally, the digitisation and the automation also allow the ESG consultant to focus more on the ESG strategy rather than investing time in mundane and repetitive tasks.

Scenario 2: ESG Reporting via traditional consulting approach

Traditional ESG consulting involves giving companies advice on how to integrate ESG considerations into their operations and plans. This entails evaluating present ESG performance, identifying problem areas, and creating strategies to advance ESG practices. While traditional ESG consulting can provide initial guidance, it often lacks the long-term sustainability and adaptability that is needed in ESG reporting in KSA. Here’s why:

1. One-time projects, no lasting capability: Most traditional ESG consultancies operate on a project basis. They create the initial report, but once the engagement ends, your internal team is left without the tools, systems, or knowledge to manage ESG processes going forward. This creates an ongoing dependence on external experts.

2. Siloed workflows: In many organisations, ESG data comes from multiple departments such as production, HR, etc. Traditional consultants often collect this data independently, without building systems to support cross-functional collaboration. This limits the ability to create an integrated and verifiable ESG reporting.

3. Unsustainable Consulting costs over time: As ESG requirements evolve, continued reliance on consultants can become costly and inefficient.

4. Lack of real-time updates: Unless specifically contracted, traditional consulting services may not include updates aligned with evolving frameworks like IFRS S1 & S2, GRI, or national standards such as CMA and Tadawul ESG guidelines. This can result in delayed compliance or missed opportunities.

5. Bottom Line for Saudi Companies: In a market moving quickly toward ESG maturity, supported by government mandates and investor interest. Traditional consulting approaches lack the agility, transparency, and long-term value needed to stay ahead.

To lead in ESG reporting in KSA, organisations should start thinking beyond compliance and toward capability-building, which involves scalability, use of tech-enabled tools that match the pace of national transformation.

For Example:

ABC Manufacturing, a large enterprise in Dammam, hires a traditional consultancy to prepare its ESG report.

- The consultancy conducts stakeholder interviews, collects manual data from HR, procurement, and EHS departments, and delivers a report aligned with GRI standards.

- After the engagement ends, ABC’s team lacks the tools or knowledge to update or maintain ESG data independently.

- As ESG disclosure requirements evolve under Tadawul and CMA, the organisation must rehire consultants each year, increasing costs and causing delays in compliance.

Outcome:

While the company completes its ESG reporting for the year, it remains dependent on external help, lacks agility, and finds it difficult to integrate ESG into long-term strategic planning. Additionally, in the traditional approach, the consultant also ends up investing more time in tedious and routine work.

Why digital-led consulting approach is the future of ESG reporting in KSA?

Saudi Arabia is actively promoting digital transformation across all sectors as part of its economic diversification strategy, which includes ESG reporting as a compliance and value-creation tool. For ESG reporting in KSA, companies should adopt digitally enabled ESG software solutions backed by consulting expertise, ensuring they remain compliant today and resilient tomorrow.

This hybrid approach not only delivers short-term results but also builds long-term ESG intelligence within the organisation, a necessity as regulatory expectations, investor scrutiny, and stakeholder demands continue to rise.

Enabling the future of sustainability reporting through digital practices

As the Kingdom accelerates its sustainability efforts, the right approach to ESG reporting in KSA can define a company’s ability to lead in the climate economy. A digitally driven consulting model offers the transparency, agility, and in-house capability building that aligns with Saudi Arabia’s Vision 2030 and ESG ambitions.

In a country where digital innovation and sustainability go hand in hand, the future of ESG reporting is clear, and it is reinventing traditional ESG consulting through the lens of digital adoption. To streamline this innovation and help companies achieve profitability in the climate market, leading ESG reporting software like The Sustainability Cloud’s TSC NetZero offers a one‑stop platform for end‑to‑end ESG management—automating data collection, aligning with 10+ global frameworks, and generating audit‑ready reports to power Saudi businesses toward Vision 2030 goals.

Also Read: Top 5 must-have features of an ESG management software