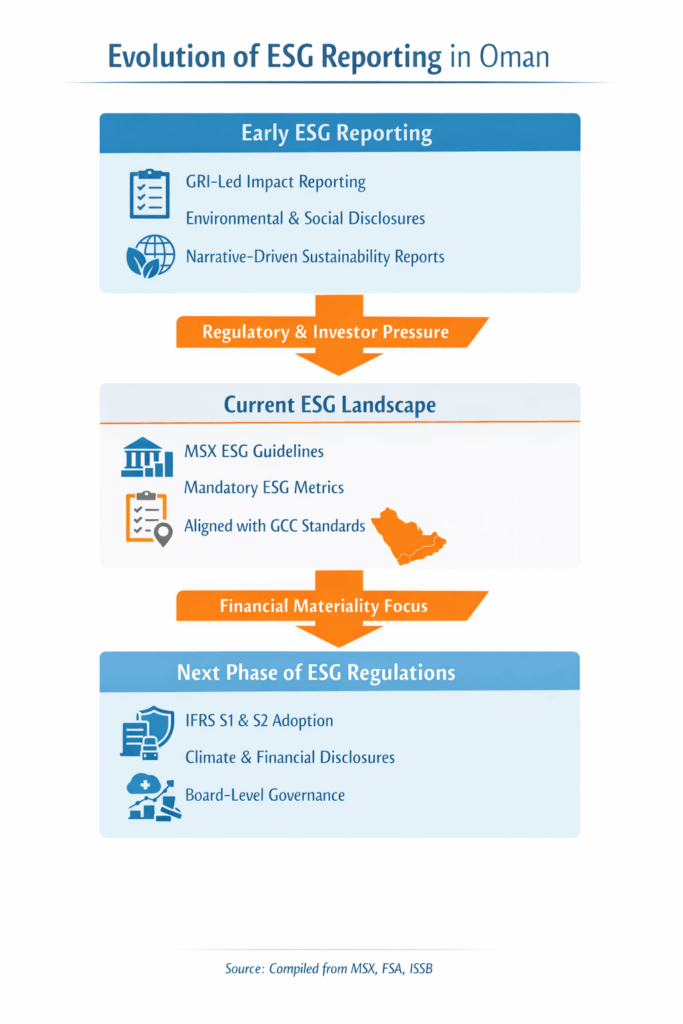

ESG Regulations Oman: ESG reporting evolution demands strategic action: From impact to financial riskOman’s approach to ESG is closely aligned with its long-term national priorities, as the country looks to diversify its economic priorities beyond oil. ESG regulation Oman matters because it directly supports the country’s economic, environmental, and institutional priorities. Under Oman Vision 2040, sustainability is positioned as a driver of economic diversification, resilience, and competitiveness. ESG compliance in Oman is being developed to ensure that corporate activity aligns with these national goals while maintaining credibility with regional and international investors.

Several forces are accelerating ESG compliance in Oman:

- Regulatory momentum, particularly from the Financial Services Authority (FSA) and the Muscat Stock Exchange (MSX).

- Capital market expectations, driven by regional and global investors.

- Climate and resource realities, including water scarcity, emissions management, and energy transition.

- Global alignment, especially with international sustainability and reporting standards.

As a result, ESG compliance in Oman is no longer limited to large listed entities; it is becoming relevant across supply chains, financial institutions, and private sector organisations. At the same time, Oman is preparing for the next phase of ESG reporting in Oman. The FSA is developing regulations to adopt IFRS S1 and S2 sustainability standards, moving ESG disclosures closer to financial risk and governance. Draft policies are currently under consultation, signalling a clear direction of travel: ESG reporting in Oman is evolving from impact narratives to decision-useful, investor-facing information.

What is already happening in Oman? | ESG regulations Oman

The Muscat Stock Exchange (MSX) introduced its ESG Disclosure Guidelines as part of a phased transition toward more structured sustainability reporting in Oman. Under these guidelines, ESG disclosures became mandatory for all MSX-listed companies from 2025, with the first reporting cycle covering 2024 activities.

Listed companies are required to disclose performance across 30 ESG metrics, structured under the Environmental, Social, and Governance pillars. The guideline is aligned with the Unified Gulf Cooperation Council (GCC) ESG Disclosure Metrics for Listed Companies, published in 2022, as well as the Global Reporting Initiative (GRI) Standards, reflecting broader GCC ESG reporting requirements.

Also Read: ESG reporting in KSA: Time to reinvent traditional ESG consulting?

From impact reporting to financial risk disclosure: How ESG reporting is evolving in Oman

The role GRI has played:

GRI has been instrumental in Oman’s ESG journey. It has helped organizations structure ESG disclosures, build internal capability, and improve transparency around environmental and social impacts. For many Omani companies, GRI provided the foundation for structured sustainability reporting in Oman.

The Shift in Market:

Investors and regulators are no longer asking only what impact a company has on society and the environment. They now require answers to:

- How do sustainability risks affect financial performance?

- How are climate and ESG risks governed and managed?

- What are the financial implications of transition risks, physical climate risks, and stranded assets?

This represents an evolution in market expectations, indicating stress by officials on making sustainability a driver of not just impact and performance but capital inward and outward flow, FDI, FII and overall financial metrics, consistent with trends in ESG reporting across the GCC.

Why IFRS Sustainability Standards Matter for ESG Regulations in Oman?

The International Sustainability Standards Board (ISSB), established in 2021 under the IFRS Foundation, develops global sustainability disclosure standards. It has issued:

IFRS S1 sets out general requirements for disclosures of sustainability-related risks and opportunities that could affect a company’s cash flows, access to finance, or cost of capital.

IFRS S2 focuses specifically on climate-related risks and opportunities, requiring companies to disclose how climate change affects their business model, strategy, and financial performance.

Global markets are converging on this approach. As of mid-2025, over 20 jurisdictions representing more than 50% of global GDP have either adopted or are implementing ISSB standards. The FSA’s planned adoption supports Oman’s national agenda and strengthens alignment with GCC ESG reporting requirements.

The Critical Difference

- GRI: Reports a company’s impact on society and the environment (outside-in perspective)

- IFRS S1/S2: Reports how sustainability risks impact the company’s financial performance (inside-out perspective)

Both frameworks are valuable and will coexist within ESG regulations in Oman, but IFRS S1/S2 demands integration with financial systems and risk management processes.

Also Read: GRI vs. New ESG Reporting Frameworks: Outdated or Still Essential?

ESG regulations Oman – What This Shift Really Means Inside Organisations?

Once ESG moves from impact narratives to financial risk disclosure, Omani companies face new internal pressures:

ESG data becomes enterprise data

Sustainability metrics can no longer be confined to sustainability teams. Data must now flow across finance, risk and compliance, operations, and procurement. CFOs and boards need traceable, defensible numbers that can withstand investor scrutiny and future assurance requirements under evolving ESG compliance in Oman.

Forward-looking, decision-useful data is required

Climate and sustainability risks must be quantified, linked to financial performance, and explained in the context of business strategy. This requires scenario analysis, consistent baselines, and assumptions that can be defended during board meetings and investor calls.

Auditability and governance expectations increase

Disclosures must stand up to investor scrutiny, board oversight, and future independent verification. As ESG reporting in Oman shifts from publishing an annual report to running a controlled, governed data process.

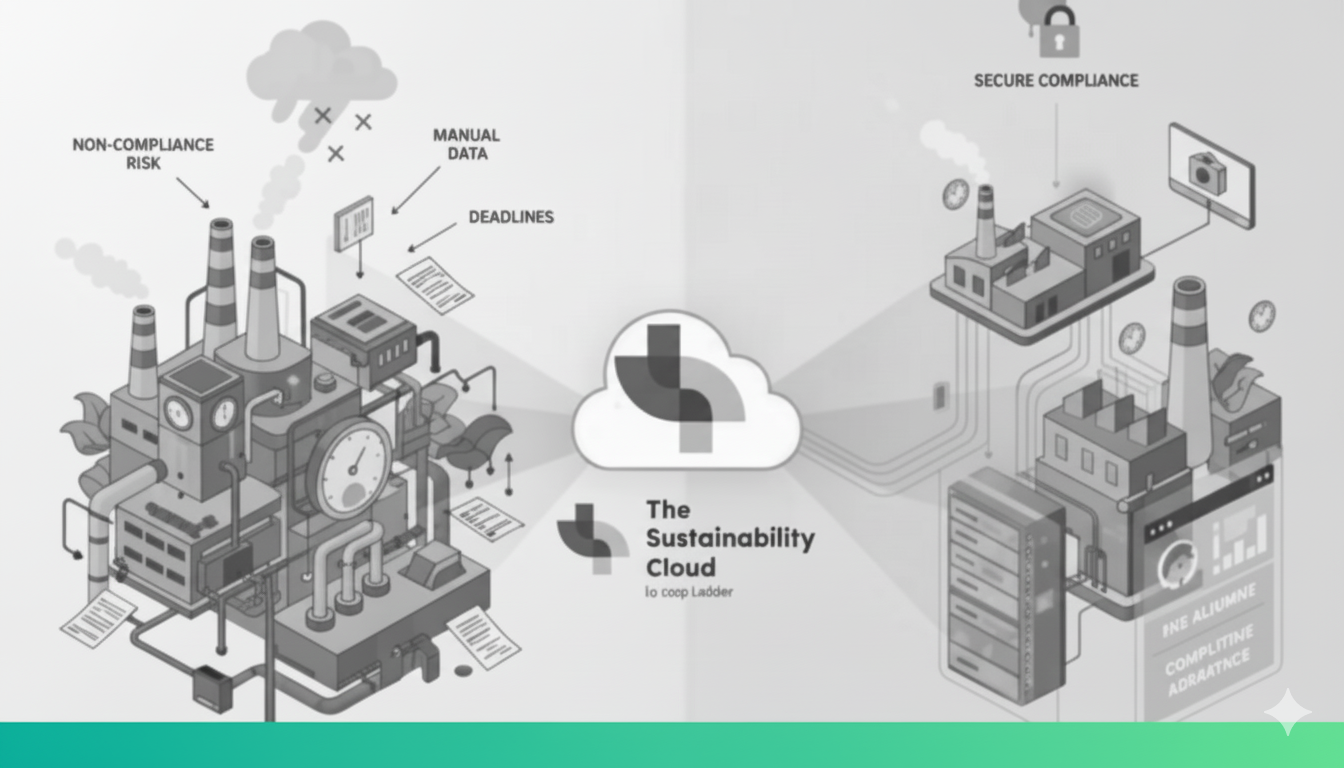

Spreadsheet-based ESG management starts to break

Manual consolidation, limited version control, and scattered data across Excel files and email chains become liabilities when ESG data must be collected from multiple departments, tracked year-over-year, audited with clear ownership trails, and aligned across multiple frameworks simultaneously.

The hidden challenge: ESG data readiness

Across Oman and the wider GCC region, common patterns emerge in how companies manage ESG data, creating friction in meeting GCC ESG reporting requirements and expectations.

Across the region, common patterns emerge in how companies manage ESG data:

- ESG data scattered across Excel files, email chains, and consultants’ templates

- Manual consolidation every reporting cycle

- Limited version control and audit trails

- Difficulty aligning GRI-style impact data with emerging financial risk and governance expectations

As Oman moves toward mandatory ESG disclosures and explores the adoption of IFRS sustainability standards, companies need repeatable, scalable systems, not one-off reporting exercises. The challenge isn’t a lack of frameworks or intent. It’s the ability to operationalise ESG internally in a way that connects sustainability data with governance, risk, and financial decision-making.

Why ESG regulation in Oman becomes a strategic enabler?

As ESG reporting in Oman moves beyond voluntary disclosures toward structured, investor-facing expectations, organizations are realizing that ESG is no longer a periodic reporting exercise. It’s an ongoing, enterprise-wide process

ESG digitization becomes a strategic enabler by:

- Creating a single source for ESG data across departments

- Aligning impact reporting (such as GRI) with financially relevant sustainability information, without treating them as separate exercises

- Enabling year-on-year tracking of ESG performance, rather than rebuilding datasets for each reporting cycle

- Supporting board-level oversight, investor discussions, and evolving regulatory expectations with consistent, traceable data

ESG can no longer sit only with sustainability teams. Organisations must involve:

- Finance teams: To integrate ESG metrics with financial reporting

- Risk and compliance: To assess and disclose material sustainability risks

- IT departments: To build data infrastructure and system integrations

- Boards and executive leadership: To provide governance and strategic oversight

Greater expectations now exist around data quality, controls, consistency, and audit readiness.

How The Sustainability Cloud support ESG compliance Oman?

At this stage of Oman’s ESG journey, the challenge is operationalizing ESG internally in line with ESG compliance in Oman and evolving GCC ESG reporting requirements.

The Sustainability Cloud, India’s oldest climate tech organisation is designed to enable organizations to:

- Manage ESG data collaboratively across functions with clear workflows and accountability

- Automate GHG accounting for Scope 1, 2, and 3 emissions in line with the GHG Protocol and PCAF requirements.

- Align with global reporting frameworks including GRI, IFRS S1 & S2, SASB standards in a single platform

- Generate consistent, audit-ready disclosures from centralized data

- Track year-on-year ESG performance without rebuilding datasets each cycle

- Build ESG data foundations that support transparency, decision-making, and long-term resilience

Rather than focusing on compliance alone, the emphasis is on building infrastructure that enables reliable, decision-useful ESG data as disclosure expectations continue to evolve.

As Oman’s regulatory landscape continues to develop, forward-thinking organizations are already building the data infrastructure, governance frameworks, and cross-functional capabilities needed for the transition from impact reporting to financial risk disclosure. 3 years is adequate time for transition to achieve the mandate, but with the right software stack.

Organizations that treat this as a compliance exercise will struggle. Those that see it as an opportunity to build better data infrastructure, improve governance, and align sustainability with business strategy will be positioned to lead. The shift from GRI to IFRS isn’t a rejection of impact reporting, it’s an expansion of expectations. Companies will need to do both, and do both well.