India aims to cut its emissions intensity by 45% by 2030, and in order to achieve the target, the Government of India has to engage with the private sector as well. In this light, the Ministry of Power, Govt of India, has launched the Carbon Credit Trading Scheme (CCTS) to further its decarbonisation targets through CCTS application. Under this scheme, the GHG emissions now hold an economic price. For every 1 tonne of emissions reduced, the Government of India, after doing its due diligence, will give a carbon credit certificate to the organisation, which can be traded for carbon credits in the carbon market. CCTS application in India marks an all-new era of industrial trading of carbon emissions.

Obligated entities under CCTS application

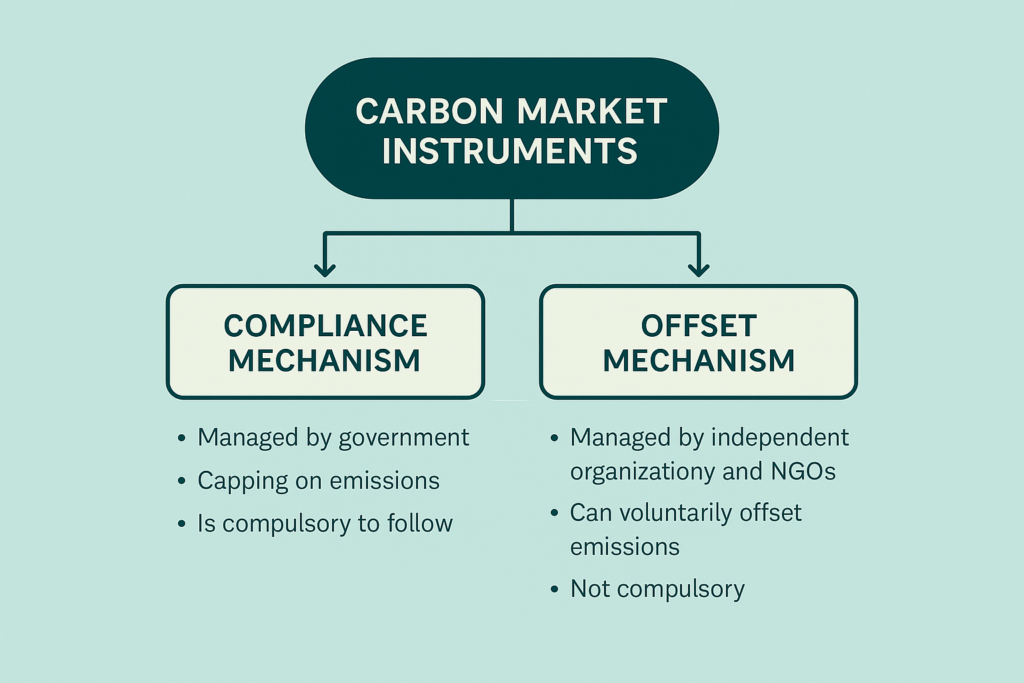

The Carbon Credit Trading Scheme (CCTS) divided into two segments:

- Compliance Mechanism: Over 250+ industries, spanning sectors like aluminium, steel, cement, etc, have been notified by the government to legally and compulsorily participate in the scheme.

- Offset mechanism: Under this category, different sectors and industries can voluntarily participate, not compulsorily, in the market to increase profit, CSR efforts and market standing. However, sectors that are encouraged to participate in this scheme are paper and pulp, agriculture, etc.

In March 2025, the overseeing agency of the scheme, the Bureau of Energy Efficiency (BEE), issued a formal document outlining the process for participating in the scheme.

If you are a company that comes under the compliance mechanism, you will have to wade through heaps of documentation, paperwork, and stakeholders, both private and public establishments.

Also Read: A practical 10-step guide to navigating CCTS India

Complete document checklist for CCTS:

Since Government documents are hefty and lengthy to navigate and read, here is the list of the most important documents you need if you are an enterprise that wants to participate CCTS application:

1. Baseline emission data report

The first document to start the CCTS Application is the ‘The Baseline Emissions Data Report’, which establishes the reference point for a company’s greenhouse gas (GHG) emissions. It helps quantify the initial emission levels against which future reductions will be measured in the CCTS application. This involves reporting of previous emissions recorded in a year. Even if the company does not monitor emissions prior to the notification, it can refer to the industry standards reports.

Key Components:

- Baseline Year Selection: The baseline year is a specific financial year chosen to establish the reference GHG emissions level. It must be based on verified data submitted by the company.

- Activity Data: Activity data refers to the amount of fuels, energy, or materials consumed or produced during the baseline year. This data is essential for calculating GHG emissions.

Example: Fuel consumption (in tonnes), electricity usage (in MWh), and production data.

- Emission Sources Identification: The report should comprehensively list emission sources within the company’s operational boundaries, which are further categorised into:

i) Direct emissions (E.g. Combustion from fuel use in boilers).

ii) Indirect emissions (E.g. Purchased electricity).

iii) Process emissions (E.g. Emissions resulting from chemical reactions).

2. Prepare an emission monitoring report

The ‘Emissions Monitoring Plan’ is the second and most crucial document of the CCTS Application, which details how the obligated entity or the enterprise will monitor, record, and report GHG emissions throughout the compliance period. In the CCTS Application, the “Gate-to-Gate” boundary should be clearly outlined, covering all relevant emissions from production processes and auxiliary systems.

Key Components:

- Monitoring Methodology:

The document has to specify which methodology the enterprise would adopt to monitor emissions.

i) Direct Monitoring: Continuous measurement at emission points (e.g., chimneys, exhausts).

ii) Indirect Monitoring: Calculations based on energy consumption or production data.

iii) Mass Balance Methodology: Tracking input-output data to estimate emissions.

- Monitoring Details:

Activity Data Collection: The document also has to outline the duration and timeframe of the data collection and its frequency: Daily, weekly, or monthly, based on process type.

- Measurement Instruments: Type of equipment used for the process (e.g., flow meters, CO₂ analysers) would also be clearly defined in the CCTS Application.

3. GHG emissions report submission

The final document of the CCTS Application is the ‘GHG Emissions Report’, which is the final documentation submitted to the Bureau of Energy Efficiency (BEE) to demonstrate compliance with Carbon Credits Trading Scheme, which contains all the final datafiles of the monitored emissions throughout the year.

Key Components:

- Submission Timeline: Must be submitted within four months of the compliance year’s end and verified by an accredited carbon verification agency.

- Contents of the Report:

i) Entity Information:

Registration number, plant details, and contact information of the manager.

ii) GHG Emission Data:

Emissions categorised by source (direct, indirect, process) along with emission intensity calculation (tonnes CO₂e per unit of product).

iii) Monitoring and Verification Details:

Reference to the monitoring plan version and any updates made during the year, and description of any operational changes affecting emissions, i.e changes in machinery, processes, etc, which could affect the final amount of emissions calculated.

iv) Emission Reduction Measures:

List of initiatives undertaken by the organisation to reduce emissions during the compliance year, and the details of GHG mitigation techniques and technologies used.

v) Verification Certificate:

Certification from an Accredited Carbon Verification Agency (ACVAs) confirming the accuracy of reported data.

vi) Performance Assessment Document:

Details of compliance with annual targets, along with the documentation of carbon credit certificates earned or surrendered.

vii) Supporting Documents:

Fuel consumption logs, sampling data, and lab analysis reports. Records of internal and external audits for cross-verification.

The Sustainable Cloud (TSC), India’s oldest sustainability management software solution provider, prepares enterprises for global and national-level disclosures while leveraging the climate economy. As a technology-driven carbon accounting platform, TSC enables companies to accurately map, manage, and report their Scope 1, 2, and 3 emissions. It equips organisations to take the first step towards a Carbon Credit Trading in India.