India is among the top four carbon emitters globally, contributing nearly 7% of global CO₂ emissions (Global Carbon Budget, 2023). With its growing industrial base and rapid urbanisation, balancing development with environmental responsibility has become a national priority. In 2015, under the Paris Agreement, India committed to reducing its emissions intensity by 45% by 2030 (compared to 2005 levels) and achieving net-zero by 2070. Meeting these targets requires large-scale decarbonisation schemes across sectors, rather than a voluntary agreement. A carbon market provides a cost-effective way for companies to take climate action — by either reducing their own emissions or financing reductions elsewhere. It puts a price on carbon, turning emissions into a tradable cost and reward system, and encourages innovation across industries. The newly launched Carbon Credit Trading Scheme (CCTS) by India is one such way to make decarbonisation profitable.

India implemented schemes like the Perform, Achieve and Trade (PAT) program under the Energy Conservation Act of 2001, which promoted energy efficiency in select sectors. However, these mechanisms didn’t cover economy-wide greenhouse gas emissions or allow for carbon credit trading. Recognizing the need for a broader legal framework, the Government amended the Energy Conservation Act in December 2022, adding new provisions to establish a national carbon market. In 2023, under this amendment, the Ministry of Power, in consultation with the Ministry of Environment, Forest and Climate Change (MoEFCC), introduced CCTS as a new scheme to make decarbonisation a business opportunity. Backed by the legal authority, CCTS gives India a formal system to reduce emissions, enhance corporate accountability, and align with global carbon markets in the years ahead.

What is the purpose of CCTS?

The Carbon Credit Trading Scheme (CCTS) is India’s framework to complement and support various entities by pricing their additional actions towards Green House Gas (GHG) emission reduction, who are undertaking projects to decarbonize the Indian economy. Under CCTS, companies can earn, buy, or sell carbon credits based on how much they reduce or exceed their greenhouse gas emissions. A carbon credit represents a quantifiable decrease in emissions. A business can sell the additional carbon credits it receives if its emissions fall short of the target. If it emits more, it will be penalised or forced to purchase credits from others to make up the difference. CCTS application makes it profitable for companies to reduce pollution by converting emission reductions into marketable incentives.

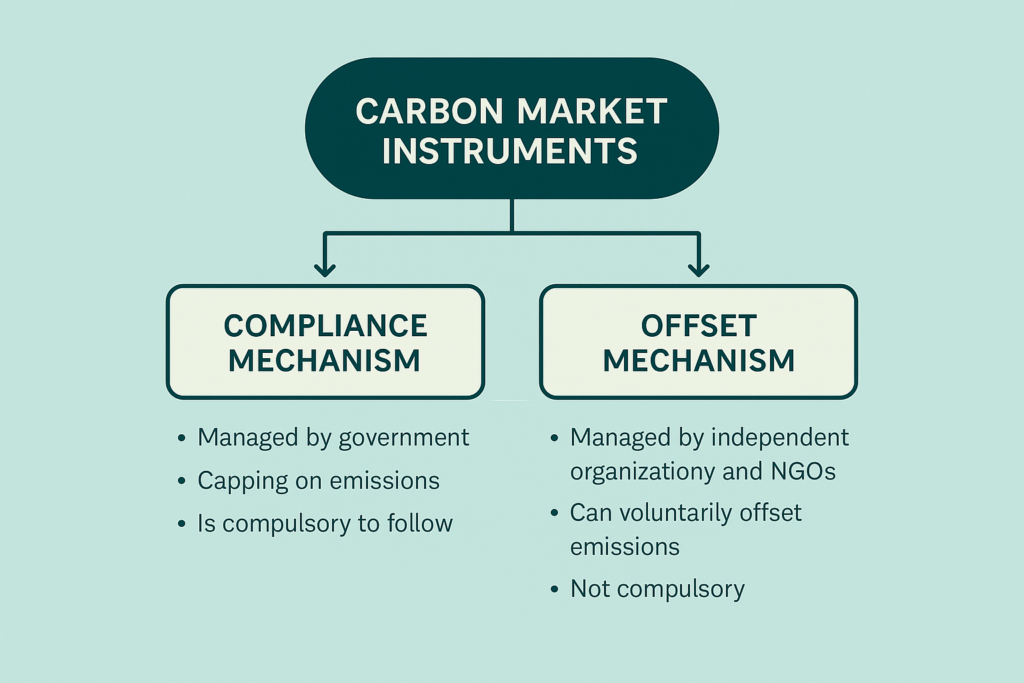

Participation in the CCTS will help companies become a part of the Indian Carbon Market. In its current state, the Indian Carbon Market Framework has two key mechanisms – the Compliance mechanism which aims to address the emissions from its energy use and industrial sectors and offset mechanism to incentivize the voluntary actions from entities (not covered under compliance) for GHG reduction, thus providing a comprehensive approach to decarbonization of the economy.

An example of carbon credits trading in India – ABC Ltd., a steel manufacturing company, emits less carbon dioxide than its assigned limit for the year by adopting energy-efficient technologies or switching to cleaner energy sources. As a result, it generates a surplus of 5,000 carbon credits. These credits hold market value and can be sold to another company, XYZ Ltd., which exceeds its emission cap and needs additional credits to remain compliant with regulatory standards. Before the transaction, ABC Ltd. gets its reduced emissions verified by an accredited third-party agency to ensure they meet all eligibility criteria. Once verified, the carbon credits are issued and registered in a central carbon registry. ABC Ltd. then transfers the 5,000 credits to XYZ Ltd. In this whole process, ABC Ltd trades carbon credits in exchange for money from XYZ Ltd.

The stakeholders involved in CCTS India

The Carbon Credits Trading in India scheme involves multiple stakeholders ranging from ministries to statutory authorities and bodies set up by an act of parliament to independent agencies and authorities by the Govt. Here’s a look at the primary stakeholders of the Carbon Credit Trading Scheme.

- Ministry of Power (MoP):

The Ministry of Power is the top authority responsible for creating the CCTS framework. It provides the overall policy direction and ensures the scheme aligns with India’s broader energy and climate goals.

- Bureau of Energy Efficiency (BEE):

Bureau of Energy Efficiency is the key operator of the CCTS. It manages the registration of companies and projects, monitors emissions data, issues carbon credits, and makes sure all activities follow the rules. - National Steering Committee for Indian Carbon Market (NSC-ICM):

This committee oversees how the carbon market functions. It reviews key decisions, approves sector-specific emission targets, and ensures the market remains transparent and credible. - Accredited Carbon Verification Agencies (ACVAs):

ACVAs are independent third-party bodies that verify whether companies and projects are truly cutting emissions. They inspect data, conduct field visits if needed, and certify the real emission reductions. Their role is critical to maintain the trust and reliability of the system. - Obligated Entities (Large Industries):

These are large industries such as steel, cement, oil refineries, and power plants that must meet assigned emission reduction targets under CCTS. They are the main players responsible for reducing India’s industrial carbon footprint, either by improving their efficiency or by buying credits.

Also Read: A practical 10-step guide to navigating CCTS India

Sectors involved in the CCTS registration

Under the CCTS application compliance mechanism, Phase 1 includes industries which emit comparatively large amounts of greenhouse gases, these 9 sectors are: Petrochemicals, Textile, Chlor Alkali, Cement, Fertilizers, Iron and Steel, Pulp and Paper and Petroleum Refinery. These industries are called “obligated entities” and have been given specific targets to cut their emissions over time.

For Voluntary offset mechanisms, the sectors covered under Phase 1 are Waste Handling and Disposal, Industries, Agriculture, Energy, Forestry, and Transport. Under Phase 2, the sectors covered are Solvent use, Construction, Fugitive emissions, and Carbon capture. For both phases, the targets aren’t defined yet, and there is no compulsion, but these sectors are also being pushed to participate in the market.

As per the guidelines issued by the Bureau of Energy Efficiency, under the CCTS registration, each sector is given benchmarks—a standardised rate of emissions that has to be cut. For example, for the aluminium and cement sectors, emissions should be cut by 2-3%.

Step-by-Step guide on how to participate in CCTS

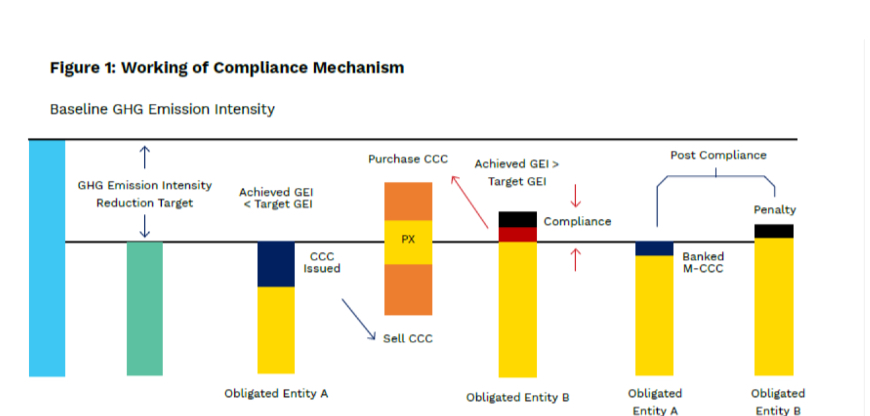

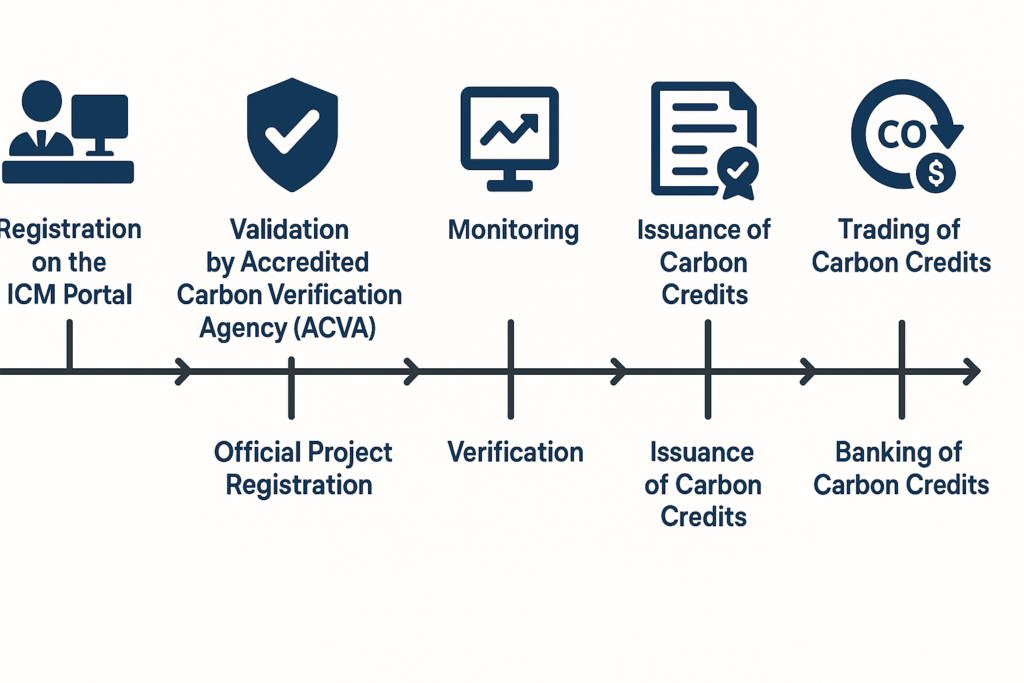

Figure shared in Ministry of Power’s report – Detailed Procedure for Compliance

Mechanism under CCTS, Version 1.0 – July 2024

The CCTS registration and application process is set up by the Bureau of energy efficiency, it involves multiple steps that goes through multiple agencies spanning government portals to independent Govt. Accredited agencies.

- Step 1: Registration on the ICM Portal –

The project developer begins by registering on the Indian Carbon Market (ICM) portal, managed by BEE. - Step 2: Prepare Project Design Document (PDD) –

A detailed proposal is prepared outlining how the project will reduce or avoid greenhouse gas emissions. This includes baseline data, methodology, expected impact, and monitoring plans. - Step 3: Validation by Accredited Carbon Verification Agency (ACVA) –

The PDD is reviewed by an independent ACVA, which checks if the proposed emission reductions are scientifically sound, measurable, and eligible under CCTS. - Step 4: Official project registration –

Once validated, the project is officially registered under the Carbon Credit Trading Scheme by BEE. - Step 5: Monitoring –

After the project is implemented, the developer must monitor the activities and collect data to track the actual greenhouse gas reductions over a specified period. - Step 6: Verification –

The monitoring data is submitted to the ACVA for verification to confirm how much CO₂ (or equivalent) was actually reduced. - Step 7: Issuance of Carbon Credits –

Based on verified emission reductions, BEE issues Carbon Credit Certificates (CCCs) to the project developer. - Step 8: Trading of Carbon Credits –

The project developer can list the credits for sale on the carbon trading platform. These can be purchased by obligated entities that need to meet their emission reduction targets. - Step 9: Banking of Carbon Credits –

If not immediately sold, the issued credits can be banked (stored) for future use or sale within the allowable time frame set by the market rules.

Also Read: Carbon Accounting In India: Best Way to Unlock Carbon Markets

Who can do carbon credits trading in India?

Companies already listed as obligated entities are automatically part of CCTS. They must monitor and report their emissions annually, either meeting their targets or buying carbon credits to balance their excess emissions.

Non-obligated companies, NGOs, startups, or individuals working on clean energy, reforestation, waste management, or other climate-friendly projects can also voluntarily join the CCTS under the Offset Mechanism. They can register their projects, get them validated, and earn carbon credits that can be sold to obligated entities.

The organisation can join through the Indian Carbon Market portal. Companies need to fill out the necessary forms, submit project information, undergo validations, and stay compliant with the monitoring and reporting standards. BEE provides clear guidelines, templates, and support to make participation smooth.

An example of carbon credit trading scheme:

A large aluminium manufacturer operating in Odisha, AAA Ltd., is an obligated entity under the CCTS. For the last financial year, its emission intensity exceeded the target set by BEE. To stay compliant and avoid penalties, AAA Aluminium logs into the Indian Carbon Market (ICM) portal and purchases 20,000 carbon credit certificates from other entities that have surplus credits — like BBB Cement Ltd., which reduced emissions below its target. This credit purchase helps AAA meet its regulatory obligations while supporting another company’s climate efforts.

The CCTS compliance mechanism is divided into two segments – Compliance mechanism and Offset mechanism, and accordingly, the sectors are also divided by stakeholders:

Compliance Mechanism

Specific yearly pollution targets are assigned to businesses in industries such as steel, cement, petroleum refining, and others under the Compliance Mechanism. These goals quantify their maximum carbon dioxide emissions per production unit. A corporation can receive carbon credits if its emissions fall short of its objective. If it emits more, it will have to purchase credits to offset the excess emissions. According to this mechanism, creating emissions is expensive, and while emissions control is lucrative. It incentivises enterprises to make investments in cleaner fuels, energy-efficient technology, and improved manufacturing methods to meet their goals and even generate additional revenue through the sale of their unused carbon credits.

The sectors covered under compliance mechanism include, petrochemicals, textiles, chlor alkali, cement, fertilisers, iron and steel, pulp and paper and petroleum refinery.

Offset Mechanism

The other segment of CCTS involves an offset mechanism and this is for entities that participate in carbon removal activities such as biochar. It is intended for people who can contribute to emission reduction, even if they are not major polluters. Projects reducing, eliminating, or avoiding emissions can be registered by businesses, project developers, NGOs, and individuals. Examples include investing in solar panels, planting trees, improving waste management, and increasing industrial energy efficiency. Project managers submit a plan, get it validated by a government accredited agency, and receive carbon credits if their project successfully lowers emissions. It is then possible to sell these credits to businesses that require them for compliance. By doing this, green projects can combat climate change and generate revenue.

Sectors covered under offset mechanism are as follows: Phase 1: waste handling and disposal, industries, agriculture, energy, forestry and transport. Phase 2: Solvent use, Construction, Fugitive emissions and Carbon capture.

Challenges for businesses in CCTS application

The CCTS India policy is a stepping stone and a landmark moment in the unfolding of the climate economy, but since the policy is in the nascent stage, it does come with some implementation challenges:

1. Limited Sector Coverage

Currently, CCTS primarily targets energy-intensive industries, leaving significant sectors like power generation outside its scope. This limited coverage can restrict the overall impact and benefits of the scheme.

2. Complex Administrative Processes

The procedures for registering projects, monitoring emissions, and verifying reductions involve multiple steps and agencies, which can be resource-intensive and time-consuming for businesses.

3. Market Volatility and Price Uncertainty

As the carbon market is still developing, fluctuations in carbon credit prices can pose financial risks, making it challenging for companies to forecast returns on sustainability investments.

4. Lack of Awareness and Expertise

Many businesses may lack the necessary knowledge or expertise to effectively participate in carbon trading, leading to underutilization of the scheme’s benefits.

Yet, for businesses that proactively navigate these initial hurdles, the CCTS registration can open a door to a new market, monetizable sustainability efforts, and a competitive edge in carbon-conscious global economy.

Advantages companies stand to gain from CCTS India

If businesses and enterprises gain a first-mover advantage by participating in this carbon economy, the yields can be exponential, not just tangible but intangible as well!

1. Revenue Generation through Carbon Credit Sales

Companies that reduce emissions below their assigned targets can earn Carbon Credit Certificates (CCCs), which are tradable assets. This mechanism transforms sustainability efforts into direct financial gains, incentivising businesses to invest in cleaner technologies. This move by the Government changes the perspective of businesses who originally looked investment into sustainability for mere goodwill.

2. Attracting Green Investments

Participation in CCTS signals a company’s commitment to environmental responsibility, making it more attractive to investors focused on Environmental, Social, and Governance (ESG) criteria. This can lead to increased access to capital, investments and partnerships.

3. Enhanced Brand Image and Market Competitiveness

Engaging in carbon trading can significantly increase a company’s reputation as a sustainable and forward-thinking enterprise, appealing to environmentally conscious consumers and stakeholders.

4. Preparation for International Trade Regulations

By aligning with global carbon management practices, companies can better navigate international regulations such as the European Union’s Carbon Border Adjustment Mechanism (CBAM), ensuring smoother access to global markets.

Want to participate in CCTS? Here’s what you need to do

Companies covered under CCTS must create a 5-year action plan that shows how they will reduce their greenhouse gas (GHG) emissions. This plan should include what steps they will take each year, how much each step will cost, what savings it will bring, and how it helps cut emissions.

They must submit this plan within one year of the scheme starting, and update it every year if needed. Every year, they must also report the steps they plan to take for that year.

At the end of each compliance year, companies must fill out a compliance report (called the Compliance Assessment Document) and submit it within one month after carbon credit trading for that year ends.

Conclusion

As the world begins to treat carbon like a new currency — a unit of value that can be traded, tracked, and taxed — India is taking a leap with its new CCTS policy, positioning itself as a frontrunner in shaping how carbon is priced and traded in emerging economies. The scheme transforms emissions management from a compliance requirement into a strategic opportunity — one that allows businesses to unlock new revenue streams, enhance market competitiveness, and align with global supply chain expectations. In this evolving regulatory and economic environment, enterprises must build robust carbon accounting capabilities and integrate emissions data into core business decision-making.

The Sustainable Cloud (TSC) – one of India’s oldest climate tech providers, offers carbon accounting services to enterprises to leverage the climate economy. As a technology-driven carbon accounting platform, TSC enables companies to accurately map, manage, and report their Scope 1, 2, and 3 emissions. It equips organisations to in the first step to CCTS application.

For complete details on CCTS, refer to the official announcement document.