In today’s evolving business dynamics, it has become important for nations to introduce statutory compliance for companies to be at par with the global governing standards. India, too, introduced a statutory reporting framework called the BRSR reporting framework, ”Business Responsibility and Sustainability Report” in 2021. It became India’s first sustainability compliance reporting framework, through which Indian companies had to disclose their ESG performance.

For listed companies, BRSR compliance is not optional. Failure to submit the mandated disclosures can lead to regulatory action by SEBI and stock exchanges, including fines, trading restrictions, and reputational damage. It may also impact a company’s ESG ratings, investor confidence, and eligibility for ESG-linked tenders or financing.

Role of ESG Reporting in Meeting BRSR Mandates

In the context of Business Responsibility and Sustainability Reporting (BRSR), Environmental, Social, and Governance factors are essential and reflect important facets of a business’s sustainability performance. In order to account a corporate’s commitment to sustainable development and ethical business practices, BRSR mandates that enterprises reveal data on their performance in each of these categories. It includes data points on myriad indicators such as number of disabled employees hired, gender parity in the workforce, employee turnover, policy on suppliers, number of awareness and training sessions conducted, etc.

Who is eligible for BRSR reporting?

BRSR reporting legally requires the top 1000 listed companies by market capitalisation to disclose their ESG performance data through a compiled report. The BRSR specifies the parameters that must be reported and provides guidance on how to do so. The general concept of the BRSR is to promote transparency, but other companies can also file BRSR reports to gain several advantages.

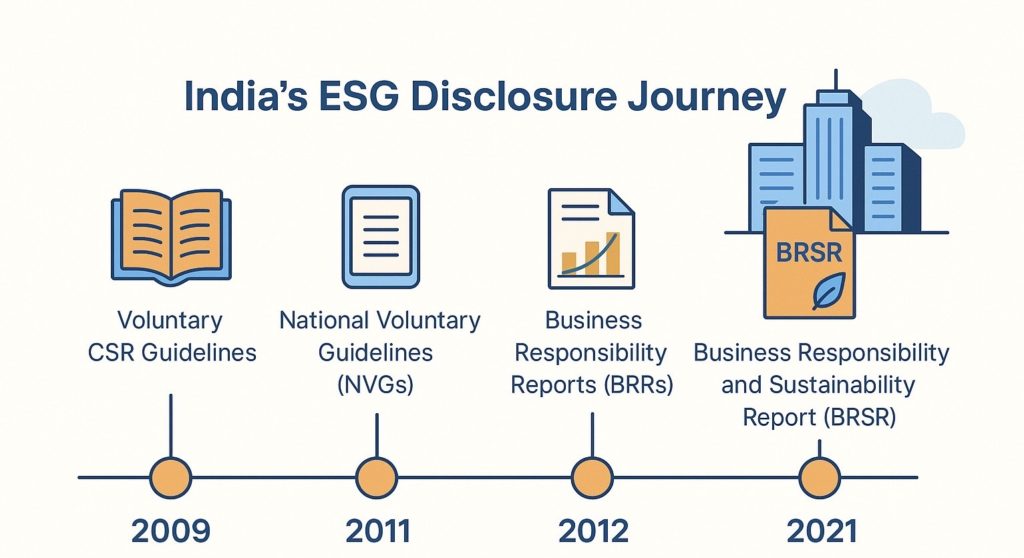

Predecessor of BRSR Reporting

India’s ESG disclosure journey began in 2009 with the Ministry of Corporate Affairs’ voluntary CSR guidelines, followed by the more detailed National Voluntary Guidelines (NVGs) in 2011. Securities Exchange Board of India (SEBI) made Business Responsibility Reports (BRRs) mandatory for the top 100 companies in 2012, later expanding to the top 500 in 2016 and encouraging Integrated Reporting in 2017.

In 2019, the NVGs evolved into the National Guidelines on Responsible Business Conduct (NGRBCs), with BRR requirements extended to the top 1000 companies. This paved the way for the introduction of the Business Responsibility and Sustainability Report (BRSR) in 2021, aligning with global ESG norms. In 2023, SEBI further refined this with BRSR Core, mandating key disclosures with assurance for the top 150 companies from FY 2023–24 onward.

What is BRSR core?

BRSR Core is a subset of the BRSR, consisting of a set of Key Performance Indicators (KPIs) / metrics under 9 ESG attributes. For the financial year 2025-2026, only the top 150 listed companies according to the market capitalisation are legally required to undertake and file BRSR Core reports. Listed companies must include value chain disclosures in their Annual Report as per BRSR Core. This covers top upstream and downstream partners that make up 75% of their purchases and sales by value, with reporting on relevant KPIs either separately or in total.

Also Read: Master BRSR reporting: Best practical BRSR step by step guide

What are the challenges of BRSR Reporting?

BRSR reporting includes numerous metrics, data points spanning across multiple departments such as operations, communications, purchasing etc., because of which there can be numerous challenges that can be faced by a company while preparing a BRSR report. Some them can be:

- Ensuring data accuracy and reliability:

A company has to compile more than 120 indicators from different departments, units, and external partners across a range of sustainability issues necessary for BRSR reporting. Maintaining accuracy and consistency becomes extremely difficult with such a broad data footprint, which spans from energy use and emissions to supply chain ethics and staff well-being. Any gaps or misreporting can affect the credibility of the entire submission.

For Example: A manufacturing company with units across five states may struggle to standardize energy consumption data or workplace safety metrics. If one unit reports incidents differently from another, the final BRSR report could present a misleading picture, raising questions about data integrity and consolidation of data becomes a cumbersome task.

- Bridging organisational governance and policy gaps

One of the key governance challenges in BRSR reporting is the absence of formal, stakeholder-approved policies aligned with the nine principles of the National Guidelines on Responsible Business Conduct (NGRBC). Even when policies exist informally, lacking board endorsement can weaken their strategic weight and regulatory validity. Bridging these gaps requires a structured approach to drafting, updating, and approving policies, which can be reflected in the BRSR report.

For Example: A company might already practice ethical sourcing, but without a documented and board-approved policy on responsible procurement, it cannot credibly report on it under BRSR guidelines.

- Prioritising High-Impact Indicators Strategically

Not all BRSR indicators carry equal weight across global ESG rating frameworks. To enhance visibility and performance in rankings like MSCI, Moody’s, or S&P, companies should pay close attention to questions that overlap with high-priority ESG themes in their sector. For instance, MSCI’s ESG ratings for textile companies place significant emphasis on raw material sourcing, carbon footprint, labour management, and supply chain standards. Addressing these specific indicators in the BRSR with diligence and transparency can boost a company’s ESG standing and investor appeal.

For Example: A textile company that clearly reports on its sustainable cotton sourcing and supply chain labour audits under BRSR will likely perform better on MSCI’s environmental and social scoring metrics.

- Getting the Right People and Skills in Place

BRSR reporting is a cross-functional exercise that involves input from several departments. The report’s Section C, which is organised according to nine NGRBC principles, addresses a variety of subjects, including governance, HR, finance, and product responsibility. For instance, the HR department usually handles Principle 3 (employee well-being), whereas the company secretary or ESG office may be in charge of Principle 4 (stakeholder participation). If the duties aren’t clearly aligned to the respective departments, misunderstandings and discrepancies can show up in the report.

However, many companies do not yet have dedicated sustainability teams. Existing employees frequently have to balance BRSR reporting with their regular duties, which results in an increased workload. To guarantee accurate reporting, they can also require upskilling in data management, ESG concepts, or policy alignment.

For Example: If a finance executive is assigned ESG-related disclosure for the first time, such as reporting on capital spent on sustainability efforts. This could result in data gaps or misunderstandings without any prior training.

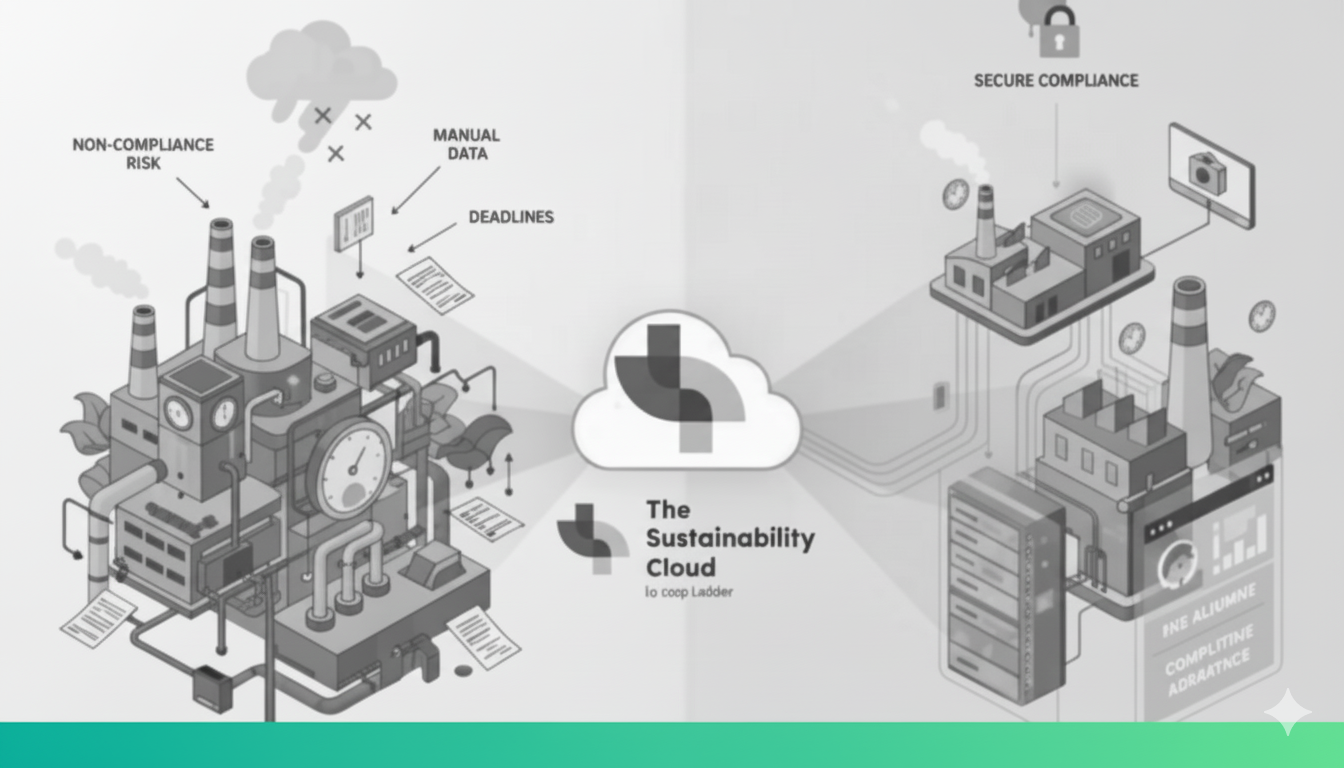

There are a number of obstacles to overcome while implementing BRSR reporting, including gathering precise data from many departments, concentrating on important ESG indicators, and handling staff members’ increased workload. In this context, BRSR reporting software can be a bridge to overcome all the challenges while reducing overhead costs significantly, helping bring all data into one place, reducing manual errors, and making it easier to track progress across different areas. It can simplify reporting, improve accuracy, and support teams in meeting both compliance and sustainability goals more effectively.

Also Read: Are you making these 5 common BRSR report filing mistakes?

What are the benefits of BRSR?

The top 1000 companies according to the market capitalisation are legally required to furnish the BRSR reporting, but the reporting framework offers many advantages to other companies as well. In order to facilitate the evaluation of a company’s overall stability, growth, and sustainability by investors, regulators, and other stakeholders, the framework aims to establish links between a company’s financial success and ESG performance.

- Enhanced Stakeholder confidence:

By reporting transparent and clear ESG performance data, businesses can draw confidence from internal as well as external stakeholders, including investors. Strong sustainability standards are now preferred by both domestic and foreign investors. Companies can get better finance options and increased market valuations by solely investing in BRSR reporting.

For example, Tata Steel’s BRSR report showing reduced carbon emissions helped them secure a $1 billion green loan. Foreign pension funds now invest more in Indian companies with good BRSR scores.

- Enhanced Business Resilience and Risk Management:

BRSR reporting allows companies to analyse governance, social, and environmental risks before they become significant issues. Businesses can better prepare for supply chain problems, regulatory changes, and climate change calamities. As a result, the company is better equipped to handle obstacles in the future.

For example, a company following BRSR reporting can identify water scarcity risks through it and can build rainwater harvesting systems. During droughts, the factories can keep running while competitors face shutdowns.

- Gaining a competitive edge while adhering to regulations

Businesses that comply with SEBI’s mandated ESG reporting standards avoid fines. Businesses that implement BRSR early get an advantage over those that are just starting to catch up. Additionally, this compliance gets businesses ready for more stringent laws in the future. Businesses that failed to meet BRSR deadlines were penalised by SEBI and lost business opportunities.

For Example, Infosys received preferred vendor status from international clients after initiating BRSR reporting early.

- India’s Standardised ESG Reporting

By establishing a single standard, BRSR enables all Indian businesses to report on their sustainability initiatives. Comparing businesses and monitoring advancements over time is made simple. Reporting is more effective and less confusing because of the uniform format and matrices.

For Example, By using the same BRSR format, investment analysis tools can now quickly evaluate the environmental performance of 2 similar companies. In the past, it was hard to compare the reporting techniques of each organisation.

- Savings and Efficiency in Operations

Through BRSR reporting, businesses can spot methods to use resources more effectively, conserve energy, and minimize waste.

For Example, ITC was able to save ₹200 crores a year by reducing packaging waste by 30% through BRSR reporting.

Also Read: CSO’s guide to top 5 BRSR Software: Features and comparison

What is included in the BRSR report?

The BRSR specifies the parameters that must be reported by the companies. The BRSR reporting consists of three main parts:

- General Disclosures:This part comprises the company’s basic information, such as its location, roadmap, staff strength, and products and services. It’s a way to represent the company profile and let readers learn about the company from this section of the report.

- Management and Process Disclosures: Next, the company specifies the procedures and guidelines that the management adheres to, when it comes to ESG. It helps determine whether the company has the prerequisites needed to implement ethical business practices.

- Principle-wise Performance Disclosures: There are 2 types of disclosures under this section:

- Essential Indicators (Mandatory): The Ministry of Corporate Affairs (MCA) established the 9 basic principles of BRSR reporting in March 2019, also called National Guidelines on Responsible Business Conduct as a set of rules encouraging ethical business practices; these are:

- Moral Business Conduct

- Product Management

- Employee Engagement and Well-Being

- Engagement of Stakeholders

- Human Rights

- Environmental Management

- Campaigning for Public Policy

- Equitable and Inclusive Growth

- Focus on the Customers

Furthermore, data consistency across all sustainability disclosures is promoted by the BRSR reporting framework, which is designed to adhere to international goals such as the UN SDGs.

Leadership Indicators (Voluntary): Voluntary disclosures are the ones that shed light on the leadership’s vision; companies are expected to report on these indicators as best practices. These indicators encompass factors such as risk management, board diversity, Scope 3 emissions, and the evaluation of health and safety among value chain partners.

Example of a BRSR Report

Failure to do BRSR Reporting

If legally mandated companies fail to comply with BRSR (Business Responsibility and Sustainability Reporting) requirements in India, they can face regulatory, reputational, and financial consequences.

- Market Regulatory Consequences:

Under SEBI’s Listing Obligations and Disclosure Requirements (LODR) Regulations, BRSR reporting is required for the top 1000 listed businesses by market capitalization. Regulation 34 imposes penalties for omitting the BRSR from the yearly report. Furthermore, under SEBI’s direction, stock exchanges like the NSE and BSE have the authority to restrict trade, freeze promoter shares, or levy financial penalties for persistent non-compliance.

- Decline in Investor Trust

When deciding how to allocate capital, many investment firms, especially global funds, use ESG reports. A corporation may be perceived as lacking transparency or a sincere commitment to sustainability if it does not submit its BRSR report. This may have a detrimental effect on stock pricing as well.

- Exclusion from Financing or Tenders

Many government and business sector bids, green finance programs, and loans tied to sustainability now require BRSR or equivalent ESG disclosures. Failure to report could result in a company’s exclusion from these opportunities, which would affect funding and growth.

Although the BRSR framework promotes more accountability and openness, its successful implementation frequently necessitates departmental collaboration, reliable data systems, skilled staff, and policy alignment. These issues call for long-term automated solutions such as robust BRSR reporting software to manage cross-functional workloads, detect high-priority indications, close policy gaps, and guarantee data accuracy.

Digital technologies and integrated sustainability platforms can benefit organisations immensely as they start to streamline their sustainability operations. The appropriate solutions can reduce reporting complexity and free teams to concentrate on long-term ESG objectives rather than immediate administrative challenges by streamlining data collection, assisting with responsibility mapping, coordinating indicators with international frameworks, and monitoring policy compliance.

The Sustainability Cloud BRSR reporting solution offers end-to-end reporting with features like 100% auditability, traceability and automated data collection. It offers integrated reporting by complying with other ESG reporting frameworks( BRSR, GRI, CSRD), climate disclosures (CDP, TNFD) and financial disclosures (SASB, IFRS S1 and S2, SFDR) as well, negating the need to incur costs for separate softwares.

Also Read: Top 5 must-have features of an ESG management software