Business Responsibility and Sustainability Reporting is India’s first sustainability reporting standard, mandating that India’s top 1,000 listed companies report their efforts towards ESG (Environmental, Social, and Governance) indicators and parameters. It includes parameters ranging from sustainable resourcing, stakeholder well-being, employee training, CSR activities, waste management, GHG emissions, Scope 1 & 2 data, etc., spanning almost all the departments of an organisation.

Businesses can benefit greatly from BRSR report in a number of ways, including increased stakeholder trust, improved brand reputation, and the attraction of sustainable investments. However, there are also difficult obstacles that must be addressed in order to guarantee accuracy, compliance, and strategic alignment.

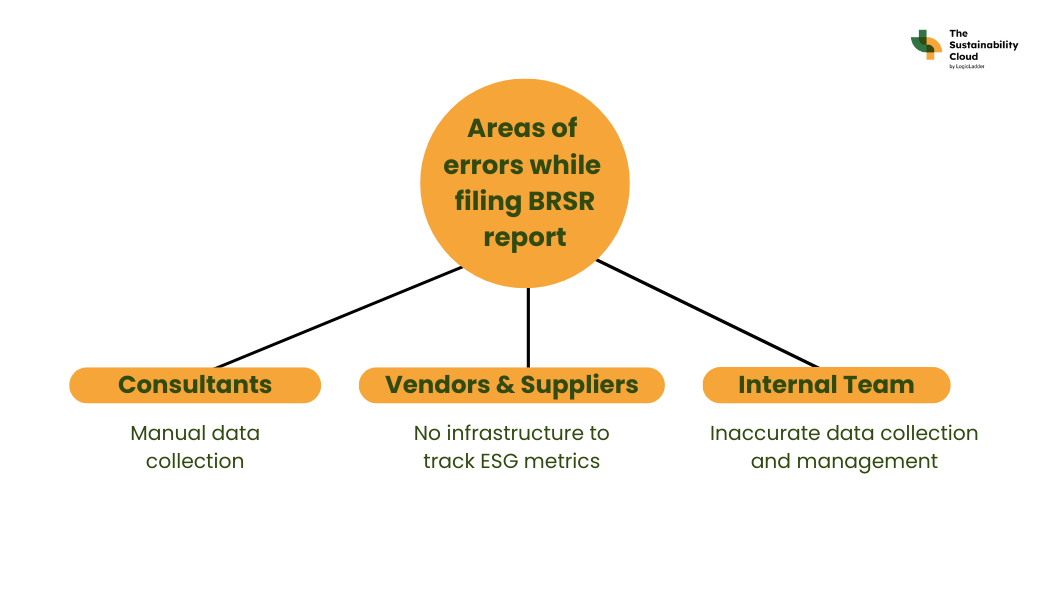

However, despite the benefits, companies often make critical errors while preparing BRSR report, which can undermine their ESG performance and credibility. A common mistake is providing generic or inconsistent responses, especially in sections like Management and Process Disclosures (Section B), where companies are required to demonstrate board-level accountability, policy implementation, and review mechanisms. For instance, a company might claim that it has a sustainability policy approved by the Board but fail to provide a web link or mention whether the policy has been translated into procedures, raising doubts about actual implementation. Such lapses can lead to regulatory scrutiny, investor skepticism, and reputational damage.

This blog outlines 5 common worries of sustainability officers filing the BRSR report, and how to address them:

Incomplete/ Inconsistent Data

According to a 2023 EY India survey, 67% of Indian companies said their biggest ESG reporting challenge was collecting accurate, comparable data from multiple business units. Most organisations amongst legally mandated to file a BRSR report, operate across various geographical locations and business verticals. Collating accurate data all year long becomes a very big challenge for the companies, especially when it comes to tracking emissions, wastewater discharge, scope 1 & 2 data points, etc. It is so because many organisations are yet to adopt digitized tools for automated data gathering, and solely rely on a manual data feeding mechanism like spreadsheets. Manually recording data from various locations is prone to mistakes and huge gaps in the datasets.

In a bid to cut costs, this is coupled with a lack of a digitised centralised system for data management which maintains a database system across different locations and geography. Lack of such digital tool can lead to loss of data, increased workload for present employees, and inaccurate data sets that do not match across the organisation, leading to chaos, delay in filling the report and increased costs due to fines.

Uncertainty Around Material ESG Topics/Navigating Materiality Assessments

According to the World Business Council for Sustainable Development (WBCSD India, 2024), only 34% of BSE100 companies publicly disclose how they conducted a materiality assessment including stakeholder engagement methodology, data sources, or how results influenced ESG strategy.

The need for double materiality is one of the most complex and difficult parts of BRSR compliance. The BRSR report requires businesses to evaluate and report on how their operations influence the environment and society (impact materiality), in contrast to standard financial reporting, which solely takes into account how external risks affect a company’s bottom line (financial materiality).

This change necessitates a new style of thinking that takes into account long-term societal concerns as well as the perspectives of external stakeholders, such as communities, NGOs, regulators, and informal workers. Many businesses, however, lack the internal resources, organized procedures, or data systems necessary to carry out a thorough materiality evaluation that meets BRSR requirements.

If the materiality process is not properly carried out and informed by stakeholders, BRSR report submissions run the danger of:

- Too general or formulaic, which diminishes confidence with investors and ESG analysts

- Misaligned with real risk and ignoring sustainability warning signs unique to a given sector

- Disconnected from the reality on the ground, particularly in businesses with remote operations, unorganized labor, or old supply chains

Also Read: BRSR reporting fundamentals every Indian company must know

Translating Qualitative Policies into Measurable Outcomes

The BRSR report contains both qualitative as well as quantitative indicators. Often organisations face difficulty in reporting qualitative questions, especially under Principle 1 – Governance, Principle 2- Employee Wellbeing, Principle 5- Human Rights and Principle 9 – Customer value.

Organisations are not able to track and tackle qualitative questions like:

- What percentage of employees were trained?

- What grievance mechanisms are in place?

- Corrective actions in case of violations, etc.

It is due to a lack of systems to track these indicators, resulting in vague responses or missing data. Many companies may also have draft ESG policies but have not operationalised them to translate into quantitative data and numbers.

To overcome this worry, the organisation should take an integrated approach towards handling qualitative data. Each policy should be mapped to the expected outcome, and then to a subsequent measurable KPI. For example,

Principle: Human Rights – vendors/suppliers –

- Percentage of vendors trained

- No.of Audits

- No. of violations

An internal system for tracking should also be finalised by assigning ownership to relevant departments, such as procurement for supply audits, HR for training, etc.

Irregularities in Supplier Data

Most businesses, whether in manufacturing, retail, FMCG, or IT services, rely significantly on outside suppliers, contractors, and vendors in today’s interconnected supply chains. However, the supplier ecosystem is sometimes overlooked when it comes to sustainability reporting, especially under BRSR report.

According to the BRSR framework’s Principles 5 (Human Rights) and 6 (Environmental Responsibility), businesses must reveal how they guarantee moral and sustainable business practices not only inside their own operations but also throughout their value chain, which includes suppliers. It includes:

- Whether suppliers follow labor laws and human rights principles

- Whether they have grievance redressal mechanisms

- If they measure and manage their own environmental impacts

- Whether they uphold fair wages, safe working conditions, gender diversity, etc.

- Sustainable resourcing

Building supplier-level visibility isn’t just for compliance; it reduces reputational risk, improves resilience, and is becoming a key requirement from global investors and clients, especially under frameworks like BRSR Core and CSRD.

To overcome this irregularity, organisations should have a proper system for vendor onboarding. It can include undergoing site visits, documentation checks, ESG compliance checks in procurement policies and contracts, etc.

Also Read: Master BRSR reporting: Best practical BRSR step by step guide

Inadequate ERP or internal system integration

The lack of integration of ESG data into core enterprise systems is one of the most frequent operational issues with BRSR report. The majority of businesses lack integrated tools for gathering, verifying, and monitoring sustainability information across divisions. Instead, the process remains manual, spreadsheet-based and disconnected from actual performance systems used in an organisation, such as ERP, HRMS, Procurement, etc., leading to errors in unit conversions or formats, lack of audit trails, delays in data aggregation etc.

To streamline BRSR reporting and improve data credibility, companies should adopt ESG data platforms specifically designed for sustainability tracking. These platforms must be integrated with existing systems like ERP, HRMS, and procurement tools through APIs to ensure seamless data flow. By setting up live dashboards that auto-update key BRSR report metrics such as gender ratio, site-level energy consumption, or training coverage, organisations can minimise manual work and improve accuracy. It is equally important to establish centralized data governance, with clearly defined metrics and built-in audit trails.

This is a critical feature as SEBI’s BRSR Core and other emerging ESG regulations increasingly require disclosures to be machine-readable, verifiable, and real-time. Companies still dependent on static spreadsheets and scattered PDFs risk not only inefficiencies but also compliance gaps that can affect investor trust and stock exchange performance.

Also Read: Are you making these 5 common BRSR report filing mistakes?

How can digitisation help in BRSR reporting?

Digital technologies and integrated sustainability platforms can benefit organisations immensely as they start to streamline their sustainability operations. The appropriate solutions can reduce reporting complexity and free teams to concentrate on long-term ESG objectives rather than immediate administrative challenges by streamlining data collection, assisting with responsibility mapping, coordinating indicators with international frameworks, and monitoring policy compliance.

The Sustainability Cloud BRSR reporting software offers end-to-end reporting with features like 100% auditability, traceability and automated data collection. It offers integrated reporting by complying with other ESG reporting frameworks( BRSR, GRI, CSRD), climate disclosures and financial disclosures (SASB, IFRS S1 and S2, SFDR) as well, negating the need to incur costs for separate software.

Also Read: Top 5 must-have features of an ESG management software