Latest Post

ESG Regulations Oman: ESG reporting evolution demands strategic action: From impact to financial risk

ESG Regulations Oman: ESG reporting evolution demands strategic action: From impact to financial riskOman’s approach to ESG is closely aligned

EU CBAM Verifiers: Complete Guide and Checklist for Indian Exporters (2026 Ready)

EU CBAM verifiers are a critical part of the Carbon Border Adjustment Mechanism (CBAM) ‘s definitive phase, which starts on

ESG Regulations Oman: ESG reporting evolution demands strategic action: From impact to financial risk

ESG Regulations Oman: ESG reporting evolution demands strategic action: From impact to financial riskOman’s approach to ESG is closely aligned

EU CBAM Verifiers: Complete Guide and Checklist for Indian Exporters (2026 Ready)

EU CBAM verifiers are a critical part of the Carbon Border Adjustment Mechanism (CBAM) ‘s definitive phase, which starts on

Featured Post

How to select a CBAM reporting software? 5 things to consider

As the world becomes more carbon-conscious, the European Union introduced the Carbon Border Adjustment

Latest CGWA Guidelines on Groundwater Monitoring

This article will share details on the Latest CGWA Guidelines issued by the regulatory

CSRD reporting decoded – Understanding the 3 Ws and H

The European Union Commission introduced the Corporate Sustainability Reporting Directive (CSRD) in 2023. Under

CGWA guidelines for individual domestic consumers extracting groundwater for swimming pools

The CGWA has issued new guidelines for using groundwater in domestic applications like swimming

CPCB’s new Directive for NCR Delhi Industries: OCEMS PTZ Camera Installation

Delhi–NCR industries (food, textile, metal) must now install OCEMS and PTZ cameras with real-time

Master BRSR reporting: Best practical BRSR step by step guide

The Business Responsibility and Sustainability Report (BRSR), India’s mandatory ESG disclosure framework for the

Partnership for carbon transparency (PACT): 4 things you must know

A detailed overview of Partnership for Carbon Transparency (PACT) and its vision to ensure

LogicLadder Empowers Central Pollution Control Board

LogicLadder Empowers Central Pollution Control Board With Real Time Monitoring Of Pollution By Indian

Omnibus package: New CBAM report filing and CSRD rules

With the introduction of the Omnibus package, global trade will witness changes and to some extent relief when it comes to CBAM reporting. It will certainly disrupt the supply chain, but not act as a hindrance to trade flows.

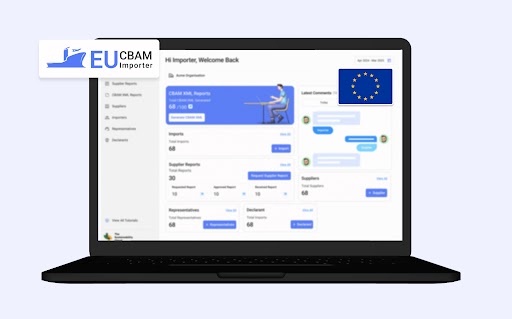

The Sustainability Cloud simplifies CBAM reporting for declarants in EU

Crafted for CBAM declarants, the software is designed to provide easy CBAM reporting solution for the EU’s €6.57 trillion import market.

One year of CBAM reporting for exporters: Key learnings and lessons

The Carbon Border Adjustment Mechanism has completed over 1 year of ongoing Transitional Phase 1 implementation. This Phase has been particularly challenging for businesses and companies as most of them continue to adapt to CBAM. In this blog, we will discuss key learnings from CBAM implementation.

6 questions every declarant needs to ask before selecting a CBAM importer tool

EU importers need a CBAM reporting tool to eliminate multiple challenges related to quarterly report generation. The right evaluation of CBAM software depends on factors such as complexities, data collection and accuracy, among others. A look at 6 questions to consider while evaluating the CBAM reporting tool for importers.

How early CBAM reporting for declarants and suppliers can protect and boost profits

CBAM is one of the most complex compliances, and everyone is new to this ecosystem. Nobody has any past experience in CBAM reporting. Hence, starting CBAM reporting gives you a competitive advantage and keeps you ahead of other players in the market. In this blog, we will understand 4 reasons why you should start early CBAM reporting:

Top 5 must-have features of an ESG management software

ESG, which stands for Environmental, Social and Governance, has been gaining unprecedented significance over the past few years. The surge in ESG policies and regulations also means increasing demand for ESG reporting platforms in India and abroad. Here are the top features that every CSO must remember when selecting an ESG reporting tool.

5 Best practices for EU importers to ensure data accuracy

EU importers have one of the most important roles in ensuring data accuracy for accurate CBAM reporting. Ensuring data accuracy by importers is a very difficult activity. However, with strategic planning and practical steps in place, emissions data and accuracy levels can be maintained.

CBAM compliance: Streamlining reporting for European fastener distributors

The European Fasteners Distributors Association (EFDA) has introduced a guidebook for non-EU suppliers of fasteners subject to CBAM. The EFDA has also created the reporting template for all EU fastener importers and their members. Know how TSC NetZero helps in CBAM reporting with the EFDA template.

Preparing for CBAM audits: Best practices for EU importers

EU importers are mandated to conduct a proper emissions data audit and cross-verify the reports submitted to them by suppliers outside the EU. Here is a look at some of the best practices that must be followed while preparing for CBAM audits.

News and media

LogicLadder was chosen by NASSCOM among the Top 10 start-ups of India.