As global carbon markets gain traction, India is stepping up with its own regulatory frameworks to put a price on emissions—and create new economic opportunities. If you’re running a business in an energy-intensive sector, you’re likely to be impacted by one of the most important of these frameworks: the Carbon Credit Trading Scheme (CCTS India).

Launched in 2023 and expanded through detailed notifications in 2025 by the Ministry of Power and the Bureau of Energy Efficiency (BEE), CCTS India lays down how businesses must monitor, report, and reduce their carbon emissions—or buy credits to comply. For many enterprises, this isn’t optional. If you’re among the obligated entities identified by the government, participation in the Compliance Mechanism is now mandatory.

But navigating official guidelines can be time-consuming and confusing. That’s why we’ve created this step-by-step, business-friendly guide to help you understand and comply with CCTS India—without getting lost in legal jargon.

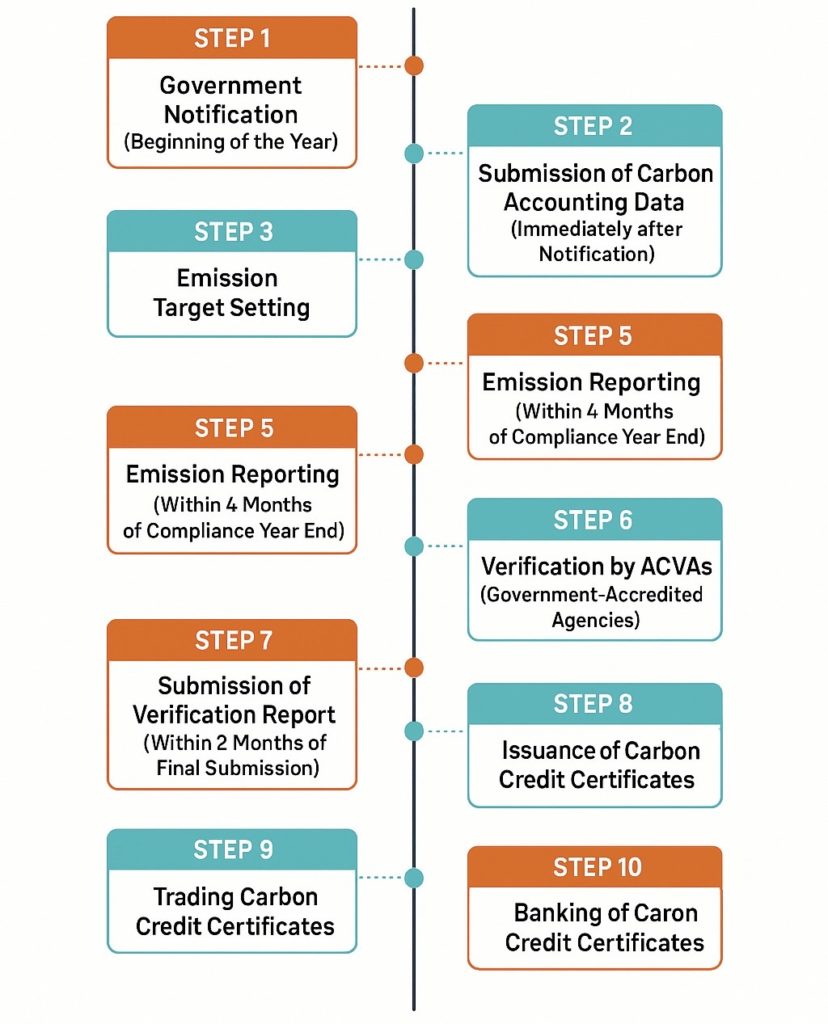

Let’s break it down into 10 clear steps.

What is the procedure for CCTS?

Step 1. Notification by the government designating organisations as an obligated entity under CCTS India

The process begins with the Central Government, the Ministry of Power (MOP), identifying and formally notifying specific industrial facilities or sectors as “obligated entities” under CCTS India.

Around 300 companies have been included in the compliance mechanism by the Government, which have been notified at the beginning of the year. These companies will now be legally mandated to participate in the carbon market.

Step 2. Sharing of the carbon accounting targets by the obligated entity with the government for setting up baseline targets for the CCTS Application

Once designated, obligated entities are required to submit detailed information about their past and current GHG emissions to the government. Through carbon accounting or standard emissions, companies will provide data on various emission sources, including fuel consumption (type and quantity), electricity usage, and process emissions specific to their industrial activities for carbon credit trading in India. This data will be used to establish “baseline targets” for the company set by the government, representing the entity’s initial emission levels, against which future reductions will be measured.

Step 3. Target emission setting by the government for the organisation

Based on the submitted carbon accounting data and in alignment with India’s national decarbonization goals, the government sets specific GHG emission intensity reduction targets for each obligated entity. These targets, often expressed in terms of emissions per unit of production (e.g., tonnes of Co2e per tonne of cement), define the level of emission reduction the entity must achieve.

The targets are notified for a trajectory period (e.g., three years), with annual targets for each compliance year.

Step 4. Developing a monitoring and reporting plan for emissions by the organisation to do CCTS registration

To ensure accurate tracking and reporting of emissions for carbon credit trading in India, each obligated entity must develop a comprehensive “monitoring and reporting plan” outlining the methodologies and procedures it will adopt to monitor and measure its GHG emissions, including details on monitoring equipment, data collection frequency, and quality control measures.

The monitoring plan needs to be submitted to and approved by the Bureau of Energy Efficiency (BEE) for CCTS India.

The obligated entity shall submit the monitoring plan to the Bureau within three months from the commencement of the first trajectory period.

The subsequent monitoring plans are required to be submitted on an annual basis and within the three months of start of the compliance year.

Also Read: Carbon Accounting In India: Best Way to Unlock Carbon Markets

Step 5. Reporting of emissions

Obligated entities are responsible for implementing approved monitoring plans and regularly collecting and recording emissions data. This can be done by reliable software that can easily integrate into an organisation’s systems, generate audit ready reports and also act as a consultant by analyzing data.

The obligated entity within four months of the completion of the compliance year shall submit the GHG emissions report and GHG Emissions pro forma duly verified by the accredited carbon verification agency to the Bureau of Energy Efficiency and State Designated Agency for compliance purposes to participate in the carbon credit trading scheme.

Step 6. Verification of the emissions compliance report by the Government-Accredited Carbon Verification Agencies (ACVAs)

To ensure the accuracy and credibility of reported emissions, the submitted emissions reports undergo independent verification by Government ‘Accredited Carbon Verification Agencies.’

These agencies, accredited by the Bureau of Energy Efficiency (BEE), audit the reported data, the implementation of the monitoring plan, and the entity’s data management systems for the verification under CCTS India scheme.

Step 7. Submission of verification report by Accredited Carbon Verification Agencies (ACVAs) to the Govt.

After completing the verification process, the verification agency prepares a detailed verification report, which includes an assessment of the accuracy and completeness of the obligated entity’s emissions report

Upon satisfying itself regarding the accuracy of the verification report and the check verification report when requested by BEE, the Bureau shall submit the report to the NSC-ICM. This submission is based on the claim made by the obligated entity in Form ‘A’ and must occur within two months from the final date of submission of the aforementioned Form ‘A’.

Step 8. Issuance of carbon credit certificates by the NSC-ISC to the organisations

If an obligated entity successfully reduces its GHG emissions below its target, it is rewarded with “carbon credit certificates.” These certificates, issued by a designated authority like the National Steering Committee for Indian Carbon Market (NSC-ICM), represent a specific quantity of emissions reductions, typically one tonne of carbon dioxide equivalent (CO2e).

The NSC-ICM shall recommend the Bureau to issue carbon credit certificates within two weeks from the date of receiving the report undeer the instructions mentioned in CCTS India scheme.

The Bureau shall issue the carbon credit certificates to the concerned obligated entity within two weeks from the date of receipt of such recommendation from the NSC-ICM on the ICM registry.

Step 9. Trading of Carbon credit certificates

The carbon credit certificates issued to entities that overachieve their emission reduction targets can be traded in the carbon market. This trading mechanism allows entities that find it costly to reduce emissions to purchase credits from those that have reduced emissions at a lower cost.

Step 10. Banking of carbon credit certificates

Obligated entities may be allowed to “bank” or save their surplus carbon credit certificates for use in future compliance periods. This banking provision offers flexibility to entities, enabling them to accumulate credits in periods of high reduction performance and use them to offset emissions in periods where reductions are more challenging or costly.

This scheme transforms emissions management from a compliance requirement into a strategic opportunity allowing businesses to unlock new revenue streams, enhance market competitiveness, and align with global supply chain expectations.

Also Read: 5 insider tips for business Carbon Accounting you need to know

The Sustainable Cloud (TSC), India’s oldest sustainability management software solution provider, offers Carbon Accounting Services to partner enterprises in leveraging the climate economy. As a technology-driven carbon accounting platform, TSC enables companies to accurately map, manage, and report their Scope 1, 2, and 3 emissions. It equips organisations to take the first step towards a CCTS application.