The Kingdom of Saudi Arabia, one of the world’s largest energy economies, has made a bold pledge to participate in this global climate economy through Saudi Arabia’s Vision 2030 and Saudi Green Initative. This marks an ambitious roadmap for economic diversification, innovation, sustainability, and global competitiveness with ESG in Saudi Arabia serving as the first stepping stone to realising the nation’s sustainability dreams.

From the very beginning, Vision 2030 was designed with sustainability as its heart and is fast getting embedded in decisions and initiatives of business operations. As Saudi Arabia transforms its economic landscape under Saudi Vision 2030, ESG reporting in KSA is guiding businesses towards a future where profitability coexists with environmental stewardship, social responsibility, and ethical governance.

What is the Saudi Vision 2030 plan?

Developed by the Council of Economic and Development Affairs, chaired by His Royal Highness Prince Mohammed bin Salman bin Abdulaziz Al Saud, Crown Prince and Prime Minister, Saudi Vision 2030 was announced in 2016 as a roadmap for the Kingdom’s long-term economic transformation. Its goal is to strengthen and diversify the economy, turning national strengths into tools for a fully diversified future. Now in its third phase, the Kingdom recently reported that 93% of national program and strategy targets have been met or exceeded.

Vision 2030 is built on three core pillars:

- Vibrant Society: Fosters a thriving society blending cultural pride with modern living and strong social services.

- Thriving Economy: Drives a dynamic economy by empowering businesses and preparing a skilled, future-ready workforce.

- Ambitious Nation: Builds an ambitious nation anchored in efficiency, transparency, and accountable governance.

When viewed through the lens of sustainability, these pillars closely align with advancing ESG in Saudi Arabia.

Social progress is central to creating a vibrant society, with investments in healthcare, education, cultural preservation, and community well-being — all of which tie into the Social pillar of ESG reporting.

The economic transformation prioritizes both Environmental and Governance aspects, promoting clean energy, innovation, and responsible industry. Landmark efforts like the Saudi Green Initiative aim to cut carbon emissions, plant billions of trees, and scale renewable energy, pushing businesses to embrace ESG Reporting in KSA and embed sustainability into their operations.

Finally, the commitment to accountable governance strengthens the Governance pillar of ESG, focusing on transparency, anti-corruption, and institutional efficiency, alongside major reforms such as subsidy cuts, industry diversification, and the partial IPO of Saudi Aramco.

Why ESG reporting is a strategic advantage for Saudi companies

Transparent ESG disclosures enable organizations to set clear goals, track progress, and improve accountability. As KSA makes a conscious shift towards diversifying its economy, ESG Reporting in Saudi Arabia will be critical for the nation to become ready to enter global markets. Increasingly, trade relations are being built on the ability of suppliers to transparently furnish ESG data, meet international sustainability standards, and demonstrate responsible business practices. Over time, companies with strong ESG performance will tend to outperform peers that overlook sustainability. Here’s a look at the key advantages of ESG in Saudi Arabia.

- Attracts Long-Term Investment

Transparent ESG reporting builds investor confidence, attracting key players like PIF (Public Investment Fund), a central financial arm of the Saudi government. It is an impactful investor with a crucial role in realizing Vision 2030 – is delivering on the country’s goals by embracing ESG principles, as it invests locally and internationally to promote long-term sustainability.

- Enhances Credibility & Reputation

Clear, transparent ESG practices strengthen brand trust with customers, regulators, and global partners, demonstrating commitment to sustainability and ethical practices. - Improves Risk Management & Efficiency

ESG reporting helps companies identify and manage risks early while improving operational efficiency, ultimately reducing long-term costs. - Boosts Global Competitiveness

Meeting international ESG standards enables access to new markets, partnerships, and global supply chains that prioritize sustainability and transparency. - Drives ROI

Effective ESG reporting delivers measurable returns by reducing risks, saving costs, and improving overall business performance.

ESG reporting, seen as a first step toward achieving Vision 2030, has also been endorsed by PIF, the country’s sovereign wealth fund. This crucial step is fundamental for both existing and emerging businesses to embrace ESG principles and drive long-term sustainability.

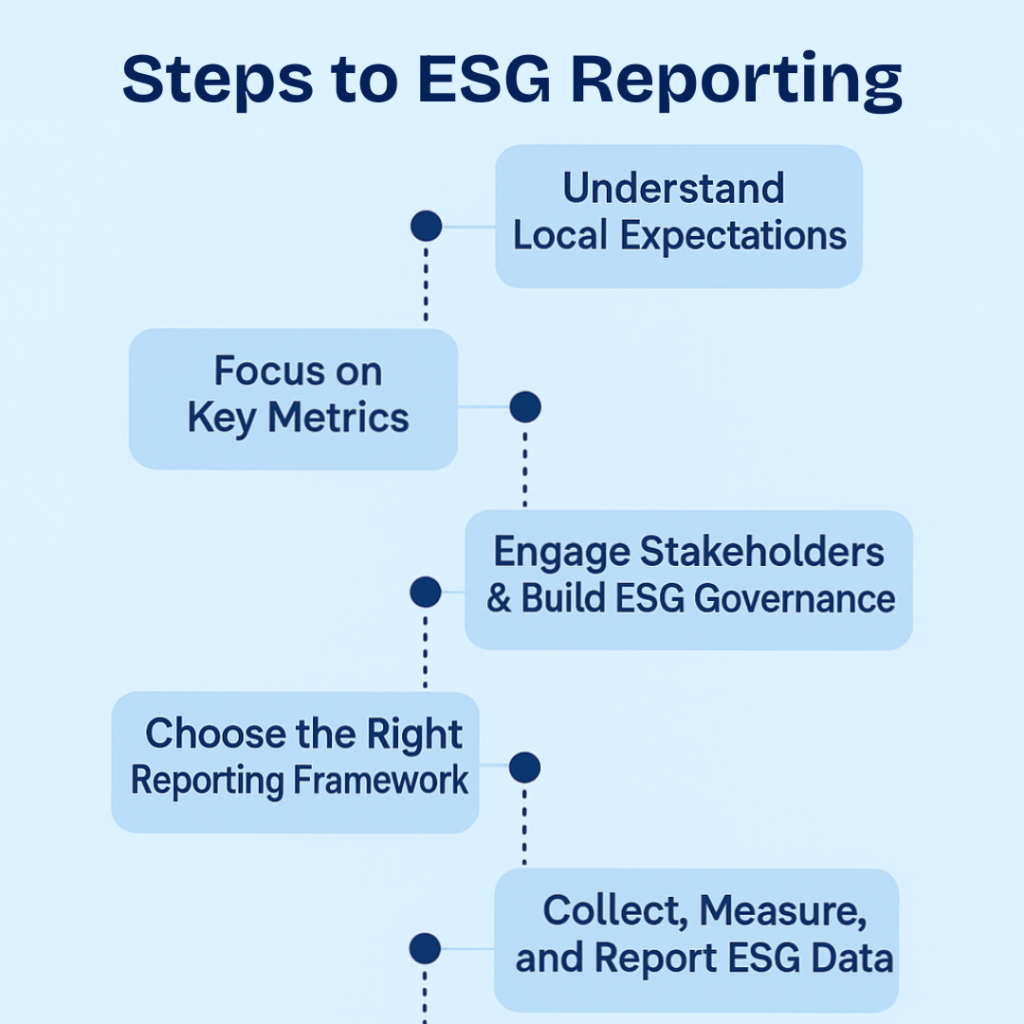

The first steps to getting started with ESG reporting

ESG reporting is globally recognized as a key tool for businesses to measure, manage, and communicate their sustainability performance. However, getting started requires a clear understanding of material topics, setting measurable goals, collecting reliable data, and aligning disclosures with recognized frameworks and standards. Here are the steps to ESG in Saudi Arabia.

Step 1: Understand local expectations

The Saudi Exchange (Tadawul) has issued ESG Disclosure Guidelines to help listed companies report on sustainability. Following these is the first step toward alignment with national goals and investor expectations.

Step 2: Focus on key metrics

Start with a materiality assessment to identify which ESG issues matter most for your industry and stakeholders. Key ESG areas include:

- Environmental: Carbon emissions, Energy use, Water consumption, Waste management, Biodiversity loss, Climate change, Energy efficiency

- Social: Employee diversity, Training, Community involvement, Child labor, Human rights, Employee Health & Safety, CSR

- Governance: Board structure & Diversity, Ethics, Compliance, Cybersecurity, Executives & Shareholders, Anti-corruption

Then, define clear ESG objectives that align with Vision 2030 and the UN Sustainable Development Goals (UNSDGs).

Step 3: Engage stakeholder & build ESG governance

- Establish an ESG governance framework: Assign clear roles across sustainability, risk, and compliance teams, including board and executive-level ownership.

- Create an ESG committee: Include representatives from relevant departments with defined responsibilities such as data collection, report consolidation, strategy development, and implementation.

- Engage investors and regulators: Maintain transparent communication to keep updated on evolving ESG expectations.

- Integrate ESG into company policies: Embed ESG goals into your risk management, ethics, and corporate strategy.

Step 4: Choose the right reporting framework

Select a global framework that suits your business model and sector like GRI – for broad, stakeholder-focused sustainability reporting, SASB – for industry-specific ESG topics, IFRS S1 & S2 – for financial and climate-related disclosures, TCFD – for disclosing climate risks and opportunities and CDP – focused on environmental impacts like carbon and water

The right framework depends on your industry, stakeholder priorities, and the level of detail you’re ready to report.

The right framework depends on your industry, stakeholder priorities, and the level of detail you’re ready to report.

Step 5: Collect, measure, and report ESG data

Accurate, data-driven ESG reporting builds credibility, ensures consistency and transparency, meets audit standards, and drives continuous improvement. Companies should establish structured systems to collect, track, analyze, and benchmark their sustainability performance using an ESG reporting software.

Key Actions:

- Define KPIs for each ESG pillar

- Use digital tools to streamline data collection and analysis.

- Benchmark performance against peers and global standards

- Verify data through third-party assurance for added credibility.

Reliable ESG data enables companies to monitor progress, identify gaps, and demonstrate measurable improvements to stakeholders.

Challenges faced by companies in ESG reporting

As ESG in Saudi Arabia gains momentum, many companies are recognizing the importance of ESG reporting in KSA to meet regulatory demands and international expectations. However, the road to effective reporting comes with several challenges that businesses must address to ensure credible and meaningful disclosures. Here’s a look at the key challenges.

- Data collection: Accurate ESG data is essential, but it’s not just about collecting it. The data must be cleaned, structured, and formatted properly for effective reporting. Manual data collection is tedious, prone to errors, and leads to delays, especially when multiple departments maintain separate spreadsheets. Without robust digital systems like a ESG reporting software, ensuring consistency and quality in reporting becomes a significant challenge.

- Sustainability infrastructure: Companies need a dedicated ESG system that enables seamless data collection, automates carbon accounting, tracks ESG metrics, and generates high-quality, auditable reports aligned with global frameworks. Without this, ESG reporting remains manual, error-prone, and hard to standardize.

- Knowledge gap: Many teams lack practical ESG experience. Certifications help, but real-world application is essential for credible, effective reporting leading to the importance of a skilled workforce adept in sustainability regulations and policies.

- ESG integration into Business strategy: ESG is often treated as an add-on rather than a core part of business strategy. Without leadership buy-in and cross-departmental collaboration, ESG in KSA will remain siloed, lack accountability, and miss its potential to drive real business value.

Opportunities for businesses with ESG reporting

With ESG in Saudi Arabia rapidly evolving, companies that embrace ESG reporting in Saudi Arabia are well-positioned to gain competitive advantages. From attracting investors to unlocking operational efficiencies, ESG opens doors to new growth opportunities in both local and global markets. Here’s a look at some of the key advantages of ESG in Saudi Arabia.

- Access sustainable finance: Tap into green bonds and ESG-linked investments, opening up new funding avenues.

- Join global supply chains: Meet international standards and gain entry to global markets driven by sustainability demands.

- Gain competitive edge: Position your company as a leader in sustainability, giving it a distinct market advantage.

- Prepare for future regulations: Stay ahead of evolving ESG regulations, ensuring compliance and minimizing risks.

- Attract ESG-conscious investors: Draw investment from funds and investors prioritizing sustainability and ethical business practices.

ESG reporting in Saudi Arabia – the gateway to unlock new markets

Saudi Arabia’s reputation for benchmarking growth and technology through innovation makes rapid sustainability adaptation a natural progression under Vision 2030, positioning ESG in Saudi Arabia as a strategic imperative.

Robust ESG reporting in KSA is key to this transition—ensuring compliance with current climate regulations and preparing companies for upcoming carbon taxes, climate‑driven disclosure rules, and evolving global standards.To streamline this journey, leading ESG reporting software like The Sustainability Cloud’s TSC NetZero offers a one‑stop platform for end‑to‑end ESG management—automating data collection, aligning with 10+ global frameworks, and generating audit‑ready reports to power Saudi businesses toward Vision 2030 goals.

Also Read: Top 5 must-have features of an ESG management software